US30, one of the most popular indices in forex trading, is an essential instrument for those looking to profit from the movements of the U.S. stock market. Whether you’re a beginner or an experienced trader, understanding what is US30 in forex and how it functions can be the key to trading success. In this comprehensive guide, we’ll explore everything you need to know about US30, including its connection to the Dow Jones Industrial Average (DJIA), how to trade it on platforms like MetaTrader 4 (MT4), and much more. Along the way, we’ll highlight real-life examples, offer actionable strategies, and explain risk management techniques.

What is US30?

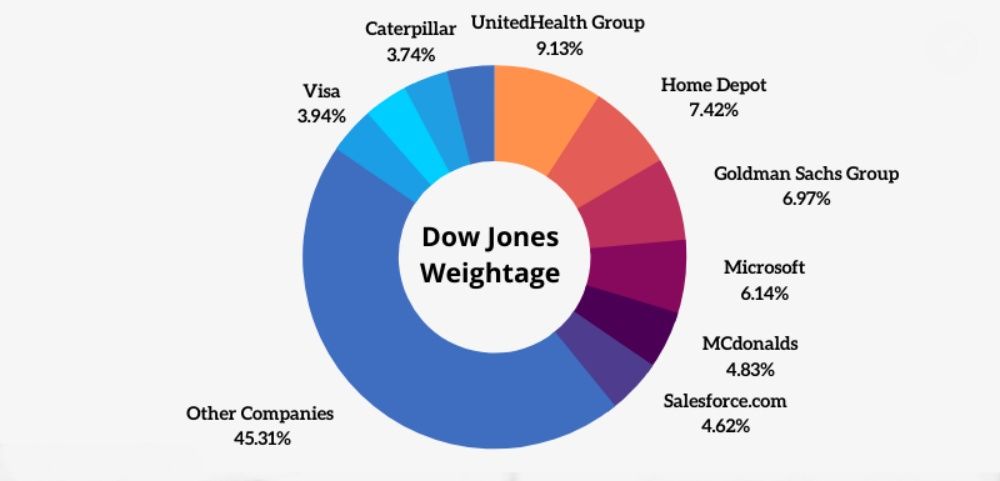

The US30, also known as the Dow Jones Industrial Average (DJIA), is a stock market index composed of 30 major publicly traded companies in the United States. These companies span across various sectors, including technology, healthcare, consumer goods, and financial services. As one of the oldest and most well-known indices globally, the Dow Jones reflects the overall health and performance of the U.S. economy.

In the world of forex trading, US30 is typically traded as a CFD (Contract for Difference). Unlike traditional stock trading, when you trade US30, you’re not buying the stocks of the companies that make up the index. Instead, you’re speculating on the price movements of the index itself. CFDs allow traders to profit from both upward and downward price movements, and they can trade on leverage, increasing both potential returns and risks.

The Connection Between US30 and Dow Jones Industrial Average (DJIA)

The terms US30 and DJIA are often used interchangeably, but they refer to the same index. The Dow Jones Industrial Average tracks the price performance of 30 prominent U.S. companies. When you trade US30 in forex, you’re essentially speculating on the value of the Dow Jones.

The US30 index is highly sensitive to the financial health of these 30 companies, which include giants like Apple, Microsoft, Coca-Cola, and Boeing. Positive earnings reports or growth in the U.S. economy can cause the index to rise, while negative news, such as weak corporate earnings or economic downturns, can lead to a decrease in its value.

Example in Practice:

Let’s say Apple Inc. reports strong quarterly earnings, far exceeding market expectations. As one of the most influential companies in the Dow, Apple’s performance can directly drive the US30 higher. Conversely, if major companies like Coca-Cola or ExxonMobil report disappointing earnings, the US30 might decline.

How Is US30 Used in Forex Trading?

In forex, What Is US30 in Forex is traded as a CFD, meaning traders speculate on the price movements of the index without physically owning the stocks that make it up. Traders can use leverage, which amplifies their potential gains (and losses). The US30 is attractive to many traders because of its volatility, which provides opportunities for profit in both rising and falling markets.

What is Leverage in Trading?

Leverage allows traders to control a larger position with a smaller amount of capital. For example, with a leverage ratio of 1:50, you could control $50,000 worth of the US30 for just $1,000 in margin. While leverage can significantly increase profits, it also amplifies losses, so it should be used cautiously, especially when trading volatile instruments like What Is US30 in Forex?.

Example of Using Leverage:

Suppose you have a $1,000 trading account and leverage of 1:50. If the US30 index moves 1% in your favor, you could earn $500. However, if the index moves 1% against you, you could lose $500. This illustrates how leverage can increase both potential profits and risks.

What Is US30 on MT4?

MetaTrader 4 (MT4) is one of the most popular platforms for trading forex, and it supports a wide range of instruments, including US30. Let’s look at how US30 is represented on MT4, and how you can add it to your platform to begin trading.

How Does US30 Appear on MT4?

On MT4, the US30 CFD is available in the Market Watch window, where you can find various instruments, including currency pairs, commodities, and indices. US30 typically appears as either US30 or DJIA, reflecting the Dow Jones Industrial Average.

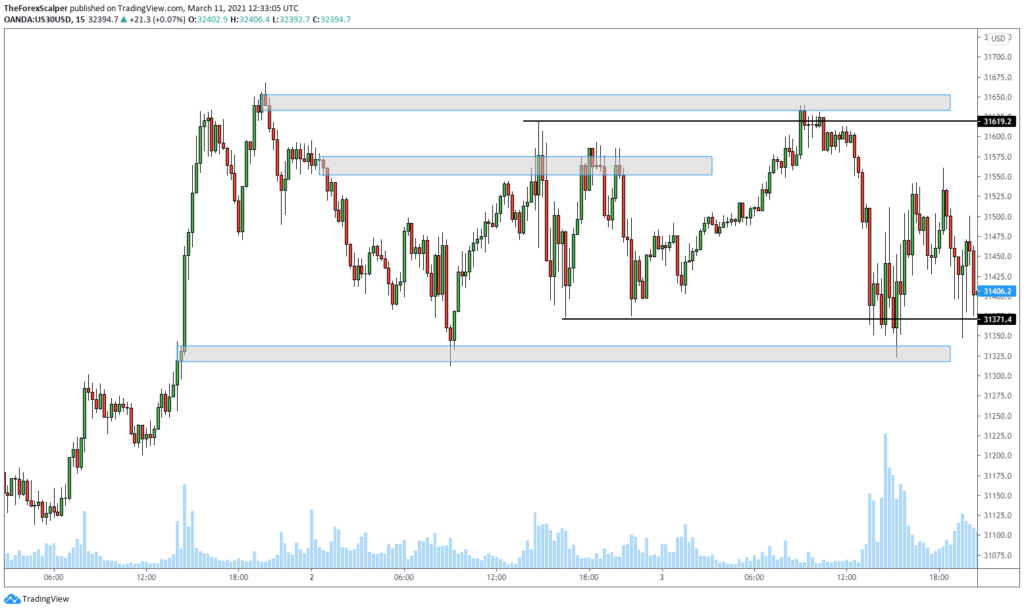

When you open the chart for US30, you’ll see the price fluctuations of the Dow Jones index in real-time. MT4 provides several tools, such as technical indicators (e.g., Moving Averages, Relative Strength Index), charting tools (e.g., Fibonacci retracement, trend lines), and timeframes to help you analyze the market and make informed trading decisions.

Adding US30 to MT4:

- Open MT4 and navigate to the Market Watch window.

- Right-click in the Market Watch window and choose Symbols.

- In the Symbols menu, search for US30 or DJIA.

- Click Show to add US30 to your list of tradable instruments.

- Right-click on US30, then select Chart Window to view its price chart.

Differences in Displaying US30 on MT4 vs Other Platforms

While MT4 is widely used for trading US30, it’s important to understand how it might look on other platforms. MetaTrader 5 (MT5) or TradingView, for example, may provide different charting tools or more advanced timeframes. However, the price behavior and factors influencing the US30 index remain the same across all platforms.

What Drives US30 in Forex?

The price of US30 is influenced by various economic and market factors. Understanding these drivers is crucial for traders who wish to profit from the fluctuations in its price.

Economic Factors That Influence US30

What Is US30 in Forex? is closely tied to the performance of the U.S. economy, and several key economic indicators influence its price movements, including:

- GDP Growth: When the U.S. economy grows, businesses generally perform better, leading to higher profits for the companies in the US30 index.

- Unemployment Rates: A low unemployment rate indicates a healthy economy, which can push the US30 higher.

- Inflation: Rising inflation may signal higher costs for businesses, negatively affecting the index.

- Interest Rates: Changes in interest rates, particularly those set by the Federal Reserve, can also significantly impact US30. For instance, when interest rates are raised, it can strengthen the U.S. dollar and lead to a decline in stock prices.

Example: Impact of Economic News on US30

During the NFP (Non-Farm Payrolls) report in the U.S., if the data shows strong job growth, it can positively impact investor sentiment, driving the US30 higher. Conversely, if the report shows weaker-than-expected job growth, it can cause the index to drop.

Strategies for Trading US30: How to Profit from Economic News

Traders often use fundamental analysis to profit from news events. For instance, consider the interest rate decision by the U.S. Federal Reserve. If the Fed raises interest rates unexpectedly, US30 might decline as higher rates could hurt corporate profits. Alternatively, if the Fed signals rate cuts to stimulate the economy, US30 could rally as investors anticipate better economic conditions.

Trading Strategy: News Trading

- Pre-release Analysis: Traders analyze economic data releases, such as the U.S. Consumer Price Index (CPI) or GDP growth, to anticipate market movements.

- Breakout Strategy: If an economic announcement causes volatility, traders can use breakout strategies, where they enter a trade once the price moves above or below a key resistance or support level.

Risk Management When Trading US30

Risk management is key when trading US30, particularly due to its volatility. Managing risk properly can help protect your capital in the face of sharp price movements.

Historical Volatility Examples:

- The 2008 Financial Crisis: The global financial crisis led to significant drops in US30, with sharp declines seen over just a few days.

- COVID-19 Pandemic: In early 2020, US30 dropped rapidly due to concerns about the economic impact of the pandemic, only to rebound later as governments injected stimulus funds into the economy.

Risk Management Strategies:

- Leverage Control: Using excessive leverage can lead to large losses. It’s advisable to trade with lower leverage when dealing with volatile instruments like US30.

- Stop-Loss Orders: Setting a stop-loss order ensures that your position is automatically closed if the market moves against you by a predetermined amount. This helps limit losses during volatile conditions.

- Hedging: Traders can hedge their positions by using opposite trades on correlated assets to protect against market downturns.

Conclusion

In conclusion, trading US30 in forex offers great opportunities for those looking to capitalize on the movements of the U.S. stock market. Understanding its connections to the Dow Jones Industrial Average, knowing how to use MetaTrader 4 to monitor the index, and applying sound risk management strategies are essential for trading success. By staying informed about economic news and employing effective strategies, traders can potentially profit from the fluctuations in US30 while managing risks.

As with all forms of trading, it’s important to practice good discipline, use proper leverage, and always be prepared for the volatility that comes with trading such a significant index. Whether you’re a beginner or an experienced trader, US30 can be a highly rewarding asset to add to your portfolio.