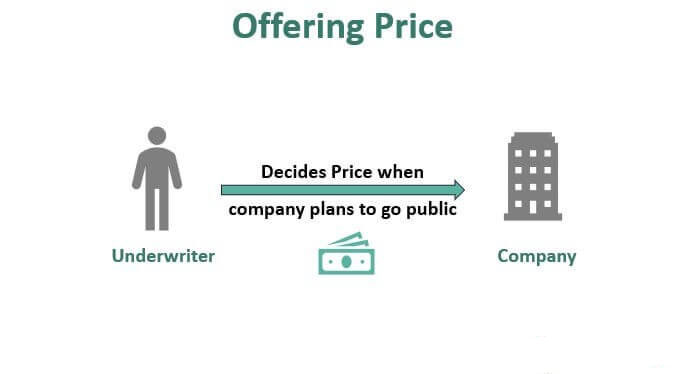

In the realms of finance and business, the term «offer price» plays a crucial role. It refers to the price at which a seller is willing to sell an asset, whether that be real estate, stocks, or goods in a retail setting. Understanding the offer price is essential for both buyers and sellers, as it significantly influences transaction outcomes. For buyers, knowing the offer price helps in making informed decisions, while sellers can strategically set their offer price to maximize profit.

Definition of Offer Price

The offer price is the initial price set by a seller for a product or service in a transaction. It is not merely a number; it encapsulates various factors, including market conditions, supply and demand dynamics, and competitive pricing strategies. When a buyer accepts this price, a transaction occurs, and both parties enter into a binding agreement.

For instance, in the stock market, the offer price is often referred to as the ask price, indicating the minimum price a seller is willing to accept for their shares. In real estate, the offer price can reflect the property’s perceived value based on market conditions and buyer interest.

Components of Offer Price

Factors Influencing Offer Price

Several key factors affect the determination of the offer price:

- Demand: High demand for a product or service generally drives the offer price up, as sellers can take advantage of increased interest.

- Supply: Conversely, if there is an oversupply of a product, sellers may need to lower their offer price to attract buyers.

- Market Conditions: Economic trends, interest rates, and consumer sentiment can influence how an offer price is set.

- Competition: The presence of similar products or services can force sellers to adjust their offer prices to remain competitive.

Offer Price vs. Market Price

Understanding the difference between offer price and market price is crucial:

- Offer Price: The price a seller proposes for a good or service.

- Market Price: The current price at which an asset is bought and sold in the market.

In transactions, these two prices interact closely. For example, if the offer price is significantly higher than the market price, the seller may struggle to find a buyer. Conversely, if the offer price is too low, the seller may miss out on potential profit.

Importance of Offer Price

Role in Negotiations

The offer price is often the starting point in negotiations between buyers and sellers. A well-set offer price can facilitate smoother discussions, while a price perceived as unreasonable may lead to a breakdown in negotiations. Buyers will typically gauge the fairness of an offer based on their research and market understanding.

Impact on Market Dynamics

The offer price can influence broader market trends. For instance, if many sellers begin to set their offer prices higher, it can lead to an overall increase in market prices, altering consumer behavior. Conversely, a trend of lowering offer prices can signal to buyers that it’s a favorable time to make purchases, impacting sales volume and inventory levels.

Strategic Pricing

Setting an effective offer price is vital for businesses. Companies often employ various pricing strategies to establish their offer prices, aiming to balance profitability with market competitiveness. A well-thought-out offer price can enhance brand perception, attract more customers, and improve sales figures.

Offer Price Examples

Example 1: Real Estate

In a real estate transaction, the offer price is typically the amount a buyer is willing to pay for a property. For instance, if a home is listed at $300,000, a buyer may submit an offer price of $280,000 based on market analysis and property conditions. Factors such as recent sales of comparable homes, property condition, and the seller’s urgency to sell all play roles in determining this offer price.

Example 2: Stock Market

In the stock market, the offer price represents the minimum price a seller is willing to accept for their shares. For example, if a stock is currently trading at $50, the offer price might be set at $52. If a buyer is willing to pay this amount, a transaction occurs. Here, the difference between the bid price (the price buyers are willing to pay) and the offer price reflects the market’s supply and demand dynamics.

Example 3: Retail Pricing

In retail, the offer price can be influenced by sales promotions or discounts. For example, a retailer may set the offer price of a jacket at $100 but provide a discount of 20%, making the effective offer price $80. Such strategies are designed to attract customers while still maintaining profit margins.

Calculating Offer Price

Methodologies for Setting Offer Price

Several common methods can be employed to determine an appropriate offer price:

- Cost-Plus Pricing: This involves calculating the total cost of production and adding a markup for profit.

- Competitive Pricing: Setting the offer price based on competitors’ pricing for similar products or services.

- Value-Based Pricing: Setting the price based on perceived value to the customer rather than just costs.

Tools and Resources

To assist in calculating and analyzing offer prices, businesses can utilize various tools and resources, including:

- Pricing Software: Programs designed to analyze market data and assist in pricing decisions.

- Market Analysis Reports: Documents providing insights into market trends and consumer behavior.

- Financial Modeling Tools: Software that helps in projecting costs and potential profits based on different offer prices.

The offer price is a pivotal aspect of transactions in finance and business. It influences negotiations, impacts market dynamics, and is essential for strategic pricing. Understanding how to effectively set and analyze offer prices can lead to better decision-making for both buyers and sellers.

Final Thoughts

Being mindful of the offer price is critical in any transaction. Whether you are buying a home, investing in stocks, or shopping for retail goods, a well-considered offer price can lead to successful outcomes and improved financial decisions. Careful analysis and strategic thinking regarding offer prices can empower both buyers and sellers in their respective markets.