In the fast-paced world of Forex trading, grasping the concept of market value is essential for investors looking to navigate this dynamic environment. Market value refers to the current price at which an asset can be bought or sold, driven by the forces of supply and demand. For Forex traders, «pips» are a fundamental element of this landscape, serving as the building blocks for price movement analysis and overall trading strategy.

What Is Pip?

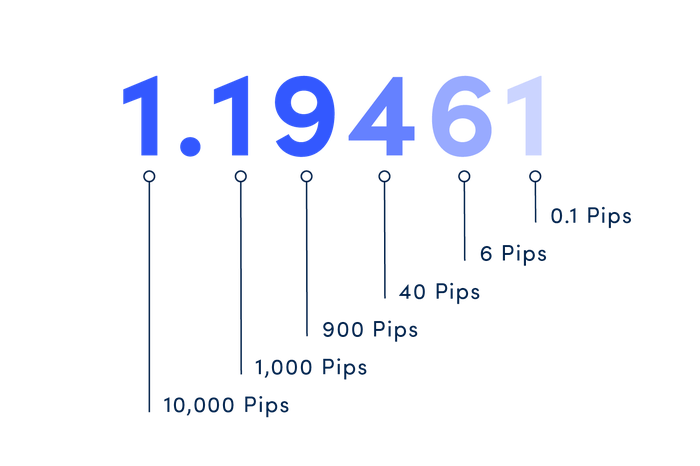

A «pip,» or «percentage in point,» is a unit of measurement used to express the change in value between two currencies. In most currency pairs, a pip is typically represented as 0.0001, while in pairs that include the Japanese yen, it is often 0.01. Understanding pips is crucial for evaluating trade performance and risk.

Definition of the Term «Pip»

A pip indicates the smallest price movement that a currency pair can make, which allows traders to track fluctuations in exchange rates. It is crucial for both determining profit and loss in trades and setting up trade strategies.

Role of Pips in Currency Trading

Pips play an integral role in Forex trading as they help traders gauge market movements and execute trades. By quantifying changes in price, traders can make more informed decisions about when to enter or exit positions. This makes pips essential for both novice and experienced traders seeking to maximize profitability.

Insights into Pips

Pips are not just a numeric value; they are vital for measuring the volatility of currency pairs and guiding traders in their strategies.

How Pips Measure Changes in Currency Rates

Pips allow traders to determine the magnitude of price movements in currency pairs. For instance, if the EUR/USD pair moves from 1.1000 to 1.1010, it has increased by 10 pips. Such measurements help traders assess market trends and potential entry or exit points.

Differences Between Standard, Mini, and Micro Lots

Understanding the various lot sizes is crucial for managing risk and capital. Here are the differences:

- Standard Lot: Represents 100,000 units of the base currency. A one pip movement equals a $10 change in value.

- Mini Lot: Represents 10,000 units of the base currency. A one pip movement results in a $1 change.

- Micro Lot: Represents 1,000 units of the base currency. A one pip movement equals a $0.10 change.

These distinctions help traders tailor their strategies based on their investment size and risk appetite.

Calculating Pip Value

To assess potential profits and losses effectively, traders need to know how to calculate the value of pips. This is a critical skill for making informed trading decisions.

Formulas for Calculating Pip Value

Calculating pip value depends on the lot size and the currency pair being traded. Here are the basic formulas:

- For Standard and Mini Lots: Pip Value = Pip Size × Lot Size / Exchange Rate

- For Micro Lots: Pip Value = Lot Size × 0.0001 (for pairs quoted to four decimal places)

Examples of Calculating Pip Value for Various Currency Pairs

To illustrate, consider trading the EUR/USD pair at an exchange rate of 1.2000:

- Standard Lot: Pip Value = 0.0001 × 100,000 / 1.2000 = 8.33 USD

- Mini Lot: Pip Value = 0.0001 × 10,000 / 1.2000 = 0.83 USD

This shows how traders can determine their potential gains or losses based on pip values.

Influence of Exchange Rate on Pip Value

The value of a pip can change with fluctuations in the exchange rate. A higher exchange rate means a lower pip value and vice versa. Traders must stay informed about these dynamics to manage their positions effectively.

Pips and Profitability

Pips are fundamental to assessing profitability in Forex trading. Each trade’s performance is often evaluated in terms of the number of pips gained or lost, making this metric essential for traders.

How Pips Impact Overall Profit and Loss

Gains and losses in Forex are commonly expressed in pips. A trade that results in a 50-pip gain can significantly impact the trader’s balance, depending on the lot size. Understanding this relationship is vital for managing expectations and performance.

Risk Management Strategies Incorporating Pips

Effective risk management is a cornerstone of successful trading. Here are some strategies:

- Set Stop-Loss Orders: Traders should establish stop-loss levels based on a specified number of pips to limit potential losses.

- Define Take-Profit Targets: Setting take-profit orders at defined pip levels helps lock in gains.

Psychological Aspects of Trading and Perception of Pips

The psychological impact of trading can be significant. Each pip represents a tangible gain or loss, influencing traders’ emotions. Developing a strong mindset helps mitigate the anxiety associated with fluctuating pip values.

Real-World Examples of Pips

Analyzing practical examples can provide deeper insights into the use of pips in Forex trading.

Specific Examples of Pip Trades

- Example 1: A trader purchases 1 standard lot of GBP/USD at 1.3000. If the price rises to 1.3050, the trader gains 50 pips, translating to a $500 profit.

- Example 2: If a trader sells 1 mini lot of USD/JPY at 110.00 and the price falls to 109.70, the 30 pip loss results in a $30 loss.

Analysis of Profitable and Unprofitable Trades

Evaluating trades provides valuable lessons. Successful trades often stem from effective pip strategies, while losses may highlight areas needing improvement. Reflecting on these outcomes can enhance trading skills.

Lessons Derived from Examples

- Establish Clear Pip Goals: Defining targets helps guide trading strategies.

- Adapt to Market Changes: Being responsive to market dynamics is crucial for successful pip trading.

- Continuous Education: Each trade offers learning opportunities regarding pip movements and market trends.

Final Remarks

Pips are an indispensable element of Forex trading, providing critical insights into market movements and helping traders assess their performance. Mastering the intricacies of pips, from calculations to psychological aspects, can significantly enhance trading strategies and overall success in the Forex market.

Key Takeaways

- Pips measure currency price movements, playing a vital role in trading strategies.

- Calculating pip value is essential for evaluating potential gains and losses.

- Effective risk management involves setting pip-based targets and limits.

- Real-world examples provide invaluable insights for refining trading approaches.

By comprehending and leveraging the concept of pips, investors can make more informed trading decisions and navigate the complexities of the Forex market with greater confidence.