In today’s dynamic trading landscape, both seasoned investors and newcomers are constantly navigating markets that are often complex and multifaceted. One such market that has garnered increasing attention over the years is the grey market. Despite being a crucial element of global commerce, the grey market is often misunderstood, and its implications for traders can be significant. In this article, we will explore what the grey market is, its impact on trading, and the various risks and strategies involved. Understanding the grey market is vital for traders aiming to make informed decisions and avoid potential pitfalls in their trading practices.

Definition of the Grey Market: What is Grey Market in an Economic and Trading Context?

The grey market refers to the trade of goods, services, or financial products that occurs through unregulated or unofficial channels, bypassing traditional market controls. Unlike the black market, where illegal activities such as counterfeit goods or illicit transactions occur, the grey market deals with goods or services that are legal in nature but are sold outside official channels. In the context of trading, the alternative market typically involves transactions that occur off official exchanges or through non-transparent platforms, where there is little to no oversight.

For example, a company selling products or assets without meeting the required legal framework, or individuals trading on platforms that operate without a license, can be considered part of the grey market. These markets thrive due to factors such as regulatory gaps, price discrepancies, or the desire for higher profit margins, often leading to a system where the buyer and seller are involved in informal market dealings that are neither fully legal nor entirely illegal.

Relevance to Traders: Why is Understanding the Grey Market Important for Successful Trading?

For traders, understanding the grey market is crucial because it can provide both risks and opportunities. Underground market activities, whether involving goods, financial assets, or cryptocurrencies, often present higher potential returns but come with increased volatility, risk of fraud, and legal uncertainty.

The risks involved include trading in non-official markets where assets may be counterfeit or manipulated, as well as engaging in transactions that could expose traders to legal consequences. On the other hand, savvy traders might use grey market opportunities to capitalize on price discrepancies between regulated and unregulated markets. However, without understanding the nature of these markets, traders could easily find themselves exposed to financial loss or legal repercussions.

What is Grey Market?

Historical Development: How and Why Did the Grey Market Emerge?

The emergence of the Parallel market can be traced back to the early 20th century when global trade became more interconnected. With the rise of global supply chains, international trade, and regulatory environments, certain market participants began to seek alternative market channels to sidestep restrictions, taxes, and other barriers to entry. Over time, grey markets evolved as a way to meet high demand for goods or services that were either difficult to obtain through traditional means or were subject to price controls, tariffs, and other limitations.

The grey market found particular prominence in parallel imports—goods imported from other countries without the approval of the brand owner or official distributor. In many cases, companies resorted to the unregulated market to avoid high costs associated with import taxes, official distribution networks, or pricing regulations. This phenomenon has only grown with the advancement of e-commerce, enabling traders to exploit grey market opportunities on a global scale.

Definition of the Grey Market in Trading: The Difference Between the Grey Market, Black Market, and White Market

In order to fully grasp what constitutes the non-official market, it is essential to distinguish it from two other types of markets: the black market and the white market.

- Black Market: This is an illegal market where goods and services are traded in violation of government regulations. It includes illegal activities like the trade of counterfeit products, drugs, arms, or even illegal securities trading.

- White Market: In contrast, the white market refers to legitimate, officially regulated markets where transactions follow all legal and regulatory standards. These markets are transparent and offer security to buyers and sellers.

The grey market lies somewhere in between, often dealing with legal products that are sold outside official channels, usually due to lower costs, lack of availability, or the desire for higher profits.

Examples of the Grey Market: Parallel Imports, Tax-Evading Deals, Unauthorized Transactions

The grey market manifests in a wide variety of forms. Some common examples include:

- Parallel Imports: Products that are sold in a country without the consent of the manufacturer, often at lower prices due to the absence of official distribution costs. While not illegal, they bypass official channels, which may result in issues with warranties, support, or product authenticity.

- Tax-Evading Deals: Transactions where goods or services are sold without the proper tax declarations, thus avoiding governmental oversight and potentially harming the economy.

- Unauthorized Securities and Cryptocurrency Trading: Trading in stocks, bonds, or cryptocurrency on platforms that are not registered with official regulatory bodies. This exposes participants to the risk of fraud, lack of legal recourse, and price manipulation.

Types of Grey Markets and Their Impact on Trading

Parallel Imports

Parallel imports have become one of the most common forms of unregulated market trading. These goods are typically purchased from markets with lower prices and then resold in countries where official distribution channels are not available or are overpriced. While this may benefit consumers in terms of lower prices, it can create a ripple effect in commodity markets, including currency and trade markets, where prices fluctuate based on the availability of goods outside of official systems.

Counterfeit Financial Products

One of the most dangerous aspects of the grey market is the proliferation of counterfeit financial products. These products—ranging from fake stocks and bonds to fraudulent options, futures, and derivatives—pose significant risks to traders. The lack of regulation in grey markets makes it easier for fraudsters to manipulate prices, create false liquidity, and sell non-existent assets, all of which can lead to massive financial losses.

Cryptocurrency Trading on the Grey Market

The rise of cryptocurrency has given birth to an entirely new off-exchange trading. Cryptocurrencies, by their decentralized nature, are often traded on unlicensed platforms that operate outside of official regulation. These grey crypto exchanges can offer lower fees and more flexible trading conditions, but they also expose traders to higher risks such as fraud, manipulation, and the complete loss of assets. The lack of oversight also makes it easier for hackers to infiltrate these markets, potentially stealing funds or compromising user data.

Black Market in Financial Instruments

In some cases, grey markets overlap with black markets, especially in the case of asset manipulation. Unofficial exchanges may be used to facilitate the manipulation of financial instruments, such as stocks, commodities, or currencies. Traders engaging in such transactions could be unknowingly participating in market manipulation schemes, leading to both financial and legal consequences.

Key Reasons for the Emergence of the Grey Market in Trading

Regulation and Its Shortcomings

The grey market often arises due to insufficient or incomplete regulation in official markets. In many instances, traders and businesses seek informal markett solutions because they are unable to operate within the confines of excessive regulation or taxation that might be in place in their region. In some cases, traders may turn to the grey market to avoid cumbersome bureaucratic procedures or high taxes imposed on certain goods.

Price Discrepancies Between Markets

The arbitrage opportunities created by price discrepancies between regulated and grey markets are a significant driving factor. For example, differences in tax rates, currency exchange rates, or market pricing can create lucrative trading opportunities for those willing to operate in the unregulated space. In many cases, traders may profit from buying products or assets in one market and reselling them in another, where prices are higher due to official restrictions.

High Demand for Unverified or Nonstandard Assets

Another reason the grey market thrives is the high demand for unverified or nonstandard assets. In some cases, traders seek high-risk, high-return assets that are not available in regulated markets. Informal markets, including those dealing in cryptocurrencies or derivatives, offer opportunities for speculators who are looking to profit from volatile assets with little regard for regulation or oversight.

Technological Progress

Technological advancements, particularly the growth of online platforms and automated trading systems, have made it easier for traders to access the non-transparent market. Online trading platforms and apps allow participants to trade in grey markets from anywhere in the world, without the constraints of traditional market regulations. These platforms often offer features such as anonymous transactions, which further increase the allure of grey market trading.

What is Grey Market and Trading on Different Markets

Trading Stocks and Bonds on the Grey Market

One of the most common forms of non-official market trading is in stocks and bonds that are not listed on regulated exchanges. In such cases, the assets are traded privately or on unofficial platforms. While this may seem like an attractive opportunity for some investors, trading stocks on the grey market is fraught with significant risks.

For example, stocks that are traded off-exchange may lack transparency in terms of their true value, and investors may find it difficult to assess the risk accurately. Additionally, there are no formal mechanisms for enforcing corporate governance or ensuring that the company behind the asset is legitimate. This makes grey market stocks particularly susceptible to price manipulation, fraud, and insider trading.

Moreover, trading bonds on the grey market can involve unregistered securities that lack the protections offered by the Securities and Exchange Commission (SEC) or other regulatory bodies. This lack of regulation opens the door for fake or misleading financial products that can cause investors to lose their entire investment.

Trading Commodities and Futures

The grey market also extends into the trading of commodities and futures contracts. These include essential goods like oil, gold, silver, and agricultural products, as well as financial products that derive their value from these commodities. Unofficial trading platforms or over-the-counter (OTC) markets may offer lower transaction fees or a different set of conditions, but these markets often lack the liquidity and transparency found in regulated exchanges.

Grey market commodity futures can be especially volatile. Without strict oversight, prices can fluctuate wildly, often based on speculation or manipulation rather than fundamental supply and demand factors. This volatility can lead to significant financial loss for traders, especially when large players engage in shadow trading or attempt to corner the market for their own benefit. Similarly, unlicensed futures brokers may offer risky margin trades that are not properly backed by the required collateral.

Forex Trading

In the world of foreign exchange (Forex) trading, the grey market often refers to unregulated platforms or brokers that facilitate currency exchange without adhering to official standards. These markets are prone to scam operations, where traders are misled about exchange rates or subjected to unfair pricing.

The risk of fraud is especially high on these grey market forex platforms, as they may not use the same safeguards in place on regulated exchanges. Manipulated rates or fake quotes can lead traders to incur substantial losses, and in many cases, these platforms lack the legal recourse available on official exchanges. Additionally, the absence of proper regulatory oversight means that anti-money laundering (AML) practices and other protective measures might not be in place, making traders more vulnerable to criminal activities.

Cryptocurrency and Blockchain

Perhaps the most high-profile example of the grey market today is in cryptocurrency and blockchain trading. While the cryptocurrency market itself is technically not «grey» by definition (since it is a relatively new and largely decentralized system), many unregulated cryptocurrency exchanges operate in a grey market capacity. These exchanges often do not comply with legal frameworks and may not have the necessary protections for investors.

Unlicensed exchanges or decentralized platforms can suffer from price manipulation, hacking incidents, or fraudulent activities. As cryptocurrency trading is less transparent than traditional stock exchanges, it is more difficult for traders to assess the value of assets or detect fraudulent activity. Additionally, the absence of insurance policies or investor protection schemes in these markets means that traders face high risks, especially when dealing with cryptocurrencies that are subject to extreme volatility.

Legal Aspects of the Grey Market in Trading

The legal status of the underground market varies depending on the jurisdiction. In some countries, grey market trading is allowed as long as the traded goods or services are not inherently illegal. However, it often operates in a legal grey area, where the activities themselves are not clearly defined by law.

For example, while parallel imports (goods sold outside of official distribution channels) are not illegal in many countries, they often violate intellectual property rights and can infringe on the trademarks of manufacturers or official distributors. Similarly, trading securities on unregulated platforms can be considered illegal under securities law, as it bypasses the protections set in place by financial regulatory authorities like the SEC or FCA.

The grey market can thus present a legal risk for traders who may unknowingly participate in illegal activities, such as money laundering or market manipulation. It’s important for traders to be aware of local laws and the legal implications of engaging in unregulated market activities.

Regulating the Grey Market

Regulating unlicensed trading has proven to be a difficult challenge for governments around the world. Since grey markets often operate across borders, establishing clear and enforceable rules can be difficult. Many governments focus on regulating licensing and certifications for financial products and services, but this is not always effective when traders move to jurisdictions with less stringent laws.

International cooperation between regulatory bodies is crucial in combating the negative effects of grey markets, such as fraud and price manipulation. Efforts have been made by organizations like the International Monetary Fund (IMF) and Financial Action Task Force (FATF) to establish guidelines for cross-border regulation and improve transparency in off-exchange trading. However, the speed with which new parallel markets evolve and adapt to changing legal frameworks poses a significant challenge.

Intellectual Property and Financial Products Rights

One of the key issues surrounding grey markets is the violation of intellectual property (IP) rights. When companies engage in parallel imports, for instance, they may bypass the official distribution channels that have established IP protections. This can lead to the unauthorized sale of products, thereby damaging the rights of the trademark holders.

In the realm of financial products, grey markets also pose risks for IP owners. Unlicensed financial products such as counterfeit stocks, bonds, or futures may infringe on the rights of the original financial instrument issuers. When these products are sold in grey markets, it can lead to significant losses for legitimate investors, as well as a breach of securities law.

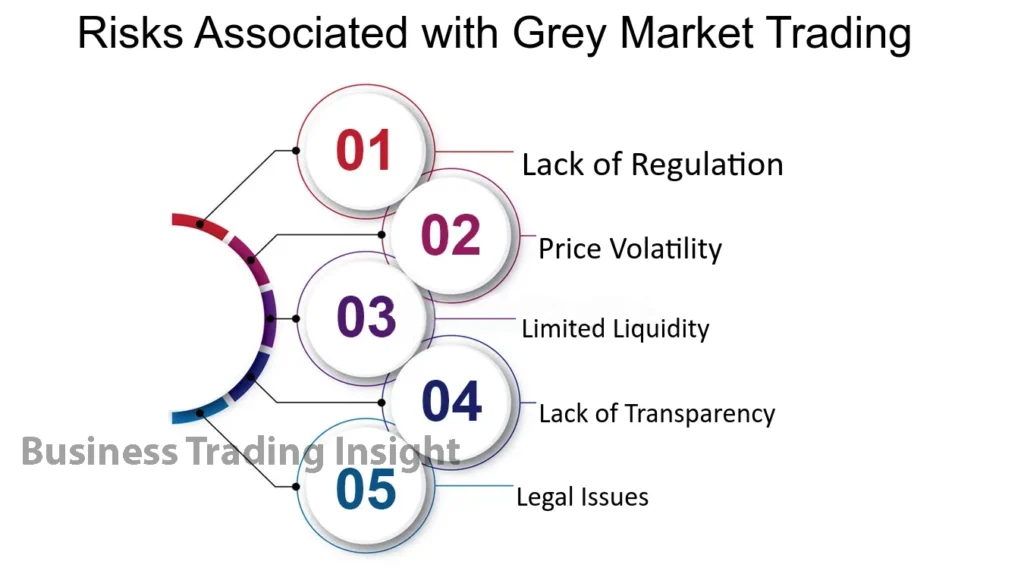

Risks and Consequences of the Grey Market for Traders

Legal Risks

One of the most immediate concerns for traders involved in grey market activities is the potential legal consequences. Traders who engage in buying or selling goods, financial instruments, or assets on the alternative market may be exposed to fines, asset confiscation, or even criminal charges if they violate local or international laws. These legal risks are heightened if a trader unknowingly engages in illegal activities, such as market manipulation, fraud, or money laundering.

For example, trading in securities on unlicensed platforms or engaging in grey market forex trading can lead to severe legal consequences, including the shutdown of trading accounts, penalties, or loss of assets. Moreover, those who deal in parallel market cryptocurrencies may be subject to strict regulations in certain jurisdictions, risking prosecution or heavy fines.

Security Risks and Fraud

Security remains one of the most significant risks when participating in the grey market, especially in unregulated financial markets such as cryptocurrency exchanges or shadow platforms. Without government oversight, there are no guarantees of safe trading conditions, and the risk of fraud is high.

Scams are rampant in grey markets, and traders often encounter fraudulent schemes such as fake exchanges, manipulated prices, or even hacked platforms. Phishing attacks and identity theft are also common on platforms with little security infrastructure.

Financial Loss Risks

The volatility of grey markets, coupled with the lack of liquidity and price manipulation, means that traders are at significant risk of financial loss. Traders may find themselves stuck with overvalued or undervalued assets due to the lack of price transparency. Moreover, unlicensed trading platforms may have transaction failures, leading to lost profits or outright financial losses.

Grey market trading also exposes traders to market manipulation, as some actors may use their positions to artificially inflate or deflate prices. Traders who fall victim to these manipulations can lose substantial amounts of money, sometimes with little recourse for recovery.

Psychological Risks

Engaging in the grey market can also lead to psychological risks, particularly for traders involved in high-stakes, high-risk activities. The uncertainty and lack of transparency can create a sense of psychological stress, especially when traders are unsure whether they are participating in a legitimate or fraudulent market.

The constant volatility and lack of official oversight can lead to irrational decision-making, as traders may become overly focused on short-term gains, ignoring long-term risks. FOMO (fear of missing out) and impulsive behavior can become more prevalent in grey market trading environments.

Trading Strategies in the Grey Market

Parallel Imports and Arbitrage

Traders who engage in grey market trading often take advantage of price discrepancies between official markets and unregulated markets. This can be a lucrative strategy, especially in the case of parallel imports or arbitrage opportunities. The key here is identifying markets where price differentials are high and leveraging them to profit from lower-cost goods or assets.

For instance, a trader might purchase products from a country with lower taxes and import duties and then sell them in a higher-tax region. Similarly, traders can profit from currency arbitrage by taking advantage of exchange rate differences between official and grey market platforms.

Independent Trading on Cryptocurrency Markets

Independent traders have increasingly turned to grey cryptocurrency platforms to profit from market volatility. These platforms often offer lower fees, faster transactions, and the ability to trade various types of cryptocurrency assets, including tokens that might not yet be listed on official exchanges. However, the lack of oversight means that risks such as hacking or fraudulent coins are ever-present.

Counterfeit Financial Instruments

Another strategy used in the grey market involves manipulating counterfeit financial instruments. Traders may seek short-term profits by purchasing or selling fake securities, options, and futures, hoping to exploit temporary price movements. This highly risky strategy requires a deep understanding of the underlying market and is usually reserved for those with experience in unregulated trading environments.