Fiat currency has become the primary instrument of the financial systems of most countries around the world. It is used not only for exchange but also as a means of saving and investment, making it an integral part of everyday life. Understanding what fiat money is, how it works, and its significance in modern economies helps clarify the mechanisms governing global financial flows.

Fiat money has gained importance in the context of globalization and rapid technological development, influencing many aspects of the financial system. Studying its nature allows us to assess its role in the economy and predict possible changes in the future.

Definition of Fiat Currency

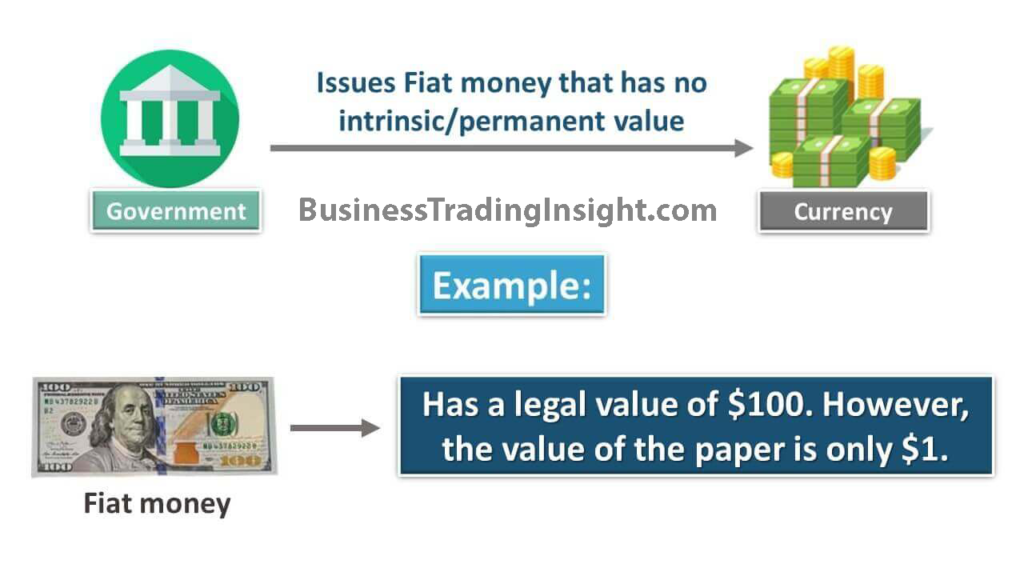

The term «fiat currency» derives from the Latin word «fiat,» which means «let it be.» Fiat money is currency that has no intrinsic value and is not backed by a physical commodity, such as gold or silver. Its value is determined by user trust and is supported by the government.

Fiat money is not just paper bills or coins; it represents a concept based on a social agreement among people. Each of us accepts fiat money as a medium of exchange because we believe others will accept it too. This makes fiat money unique in the financial world.

Differences between fiat currency and other types of currency:

- Commodity Money: Has intrinsic value (e.g., gold, silver).

- Banknotes and Coins: Physical forms of fiat money that have no value on their own without trust.

- Cryptocurrencies: Decentralized currencies based on blockchain technology that lack government backing.

History of Fiat Money

Fiat money began to take shape as trade relations and economies developed. Initially, people used commodity money, such as gold and silver, which had intrinsic value. However, as trade expanded and economic relationships became more complex, the need for a more flexible system arose.

The history of fiat money includes several key stages. First, people used commodity money for exchange; then, they began to transition to banknotes, which represented a promise to exchange for goods. In the 20th century, many countries abandoned the gold standard and shifted to fiat money, allowing governments to manage their economies more flexibly but also increasing the risk of inflation.

What is Fiat Currency?

Fiat currency has several essential characteristics that distinguish it from other forms of money. It has no intrinsic value and is supported by the government, meaning its value is determined by the trust in the government and the economy. Central banks control the money supply, enabling them to regulate the economy and manage inflation.

Thus, fiat currency becomes a universal medium of exchange accepted by all participants in the economy.

Fiat Money vs. Commodity Money

Fiat money and commodity money have their own advantages and disadvantages. Commodity money, such as gold or silver, has intrinsic value, but its use is limited by physical resources and requires storage. In contrast, fiat money is easier to print and control, allowing central banks to respond quickly to economic changes. It is more convenient for everyday transactions and can be used in electronic form, significantly simplifying payments.

Examples of Fiat Currency

The most well-known fiat currencies include the US dollar, the euro, the ruble, and the yen. The US dollar is the world’s reserve currency, widely used in international transactions. The euro unites 19 countries in the Eurozone, simplifying economic relations within the region. The ruble plays an essential role in the post-Soviet space, while the yen is a key currency for Japan and is actively used in international trade.

Each of these currencies has its own characteristics and impact on the global economy.

Why is Fiat Money Valuable?

The value of fiat money is determined by several key factors. First, there is trust in the government. A stable government and transparent policies enhance trust in the currency, allowing people to use fiat money for transactions. Second, economic stability plays a crucial role; low inflation and steady economic growth contribute to the currency’s value. Third, the effectiveness of the central bank’s monetary policy strengthens trust in fiat money, as sound management of the money supply creates a stable financial environment.

Why Do Modern Economies Prefer Fiat Money?

Modern economies prefer fiat money due to its flexibility and regulatory capabilities, which allow for effective management of economic processes. Central banks can control inflation and interest rates, quickly adapt to economic conditions, and prevent crises. Furthermore, fiat money is more convenient for everyday transactions, making it more accessible for individuals and businesses.

Alternatives to Fiat Money

Alternatives to fiat money include cryptocurrencies and commodity money. Cryptocurrencies, such as Bitcoin and Ethereum, are decentralized currencies that do not rely on governments and offer anonymity. They utilize blockchain technology to ensure transaction security. However, high volatility and the lack of government backing can limit their use.

Commodity money, while having intrinsic value, is less convenient for everyday transactions since it requires physical storage and transportation.

Does Fiat Money Lead to Hyperinflation?

Hyperinflation is a rapid and uncontrolled increase in prices, often caused by excessive issuance of fiat money. Examples of hyperinflation can be seen in countries like Zimbabwe and Venezuela, where unchecked fiat money issuance led to currency devaluation. These cases highlight the importance of proper management of the money supply and the economy as a whole.

Advantages and Disadvantages of Fiat Currency

Fiat money has several advantages, including flexibility and control over the money supply. They enable governments to respond to economic changes and provide accessibility for the population. However, there are also disadvantages, such as the risk of inflation and dependence on government policy. Governments must monitor economic conditions and take measures to maintain trust in fiat money.

Fiat money plays a key role in modern economies by providing flexibility and control. Understanding how it works and its significance allows for better navigation of global financial processes. In the future, fiat money is likely to remain the primary medium of exchange, despite the emergence of alternative forms of currency. Effective management of fiat money will be an essential task for governments and central banks to maintain economic stability and confidence in the currency.