Open orders are a cornerstone of modern trading, and mastering them is essential for both beginner and experienced traders. In this expanded guide, we will dive deeper into the mechanics of open orders, strategies for their effective use, and advanced techniques tailored to the needs of more experienced traders. By exploring practical examples, risk management strategies, and discussing how to use open orders in different market conditions—such as during volatile news events—we will equip traders with the knowledge to optimize their strategies and achieve better risk/reward profiles.

What is an Open Order?

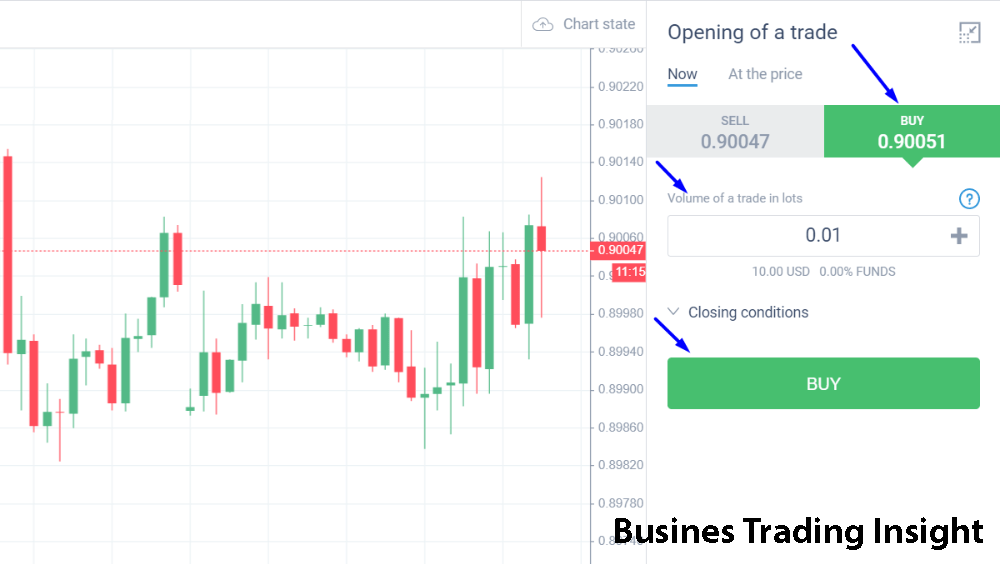

An open order refers to a trade instruction given by a trader to buy or sell an asset at a specific price or under specific conditions. Unlike a market order, which is executed immediately at the current price, an open order remains unfilled until the market reaches the specified price or until the trader cancels the order.

For example, imagine you place a limit order to buy a stock at $100 per share. If the stock’s price never drops to $100, the order remains open until either the market price reaches $100 or you decide to cancel it.

Open orders are an essential tool for automating trading strategies, allowing traders to step back from the screen and let the market execute trades based on pre-defined conditions.

How Do Open Orders Work?

Open orders function as instructions to the market but are not executed until certain conditions are met. These orders remain open on the market until they are either filled, canceled, or expire. Understanding the mechanics behind how orders function is key to managing trades effectively and avoiding unnecessary risks.

Here’s how open orders operate in different scenarios:

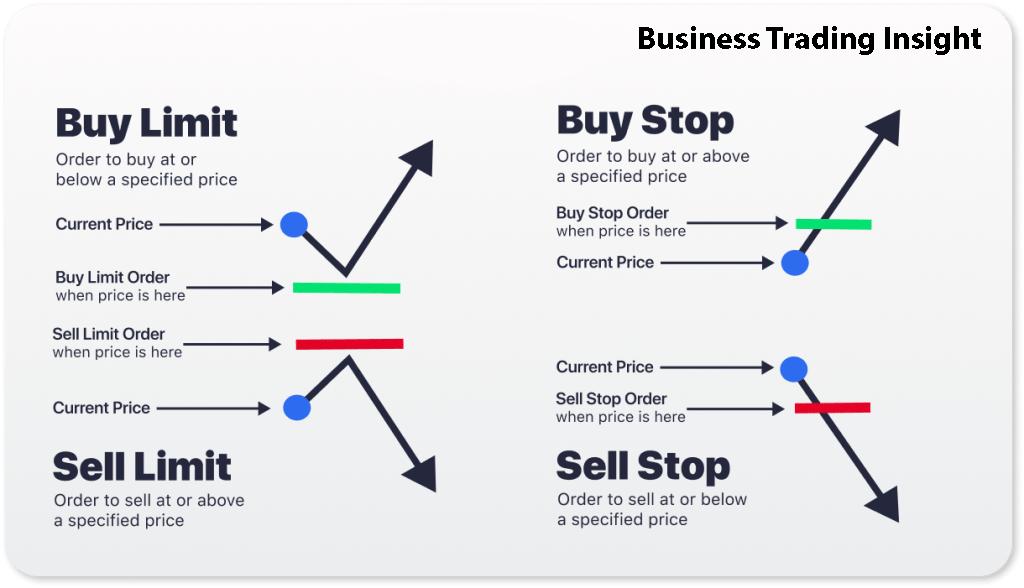

- Limit Orders: These orders are placed to buy or sell an asset at a specified price or better. A limit order will only be executed when the price reaches or exceeds the trader’s target price. This is an essential tool for those who want to control their entry and exit points more precisely.

- Market Orders: These orders are executed immediately at the current best available price. While they guarantee execution, they don’t allow traders to control the price at which the trade is executed.

- Stop Orders: Also known as stop-loss orders, these are used to limit losses or lock in profits. They become active only when the price reaches a predetermined level and turn into market orders once triggered.

- Good ‘Til Canceled (GTC) Orders: These orders remain active until they are filled or manually canceled by the trader. GTC orders are useful for traders who want to leave their orders open for a prolonged period, such as in long-term trading strategies.

- Day Orders: Day orders are valid only during a single trading session. If the order is not filled by the end of the trading day, it is automatically canceled.

Types of Open Orders and Their Application

Understanding the various types of open orders is essential for managing risk and maximizing profitability. Below are the most commonly used order types, with examples of how they can be utilized in different market conditions:

Limit Orders:

- Usage: Limit orders are widely used by traders who wish to buy or sell at a specific price. This is especially valuable in volatile markets, where prices may fluctuate rapidly.

- Example: If a stock is currently trading at $110, but you only want to buy it at $100, you would place a limit order. The order remains open until the stock price reaches $100.

- Advanced Use: For experienced traders, limit orders can be combined with technical analysis. For instance, a trader might place a limit order to buy a stock when its price hits a support level based on a multi-timeframe analysis.

Market Orders:

- Usage: Market orders are best used when execution speed is a priority, such as during breakout trades or when entering or exiting positions quickly during low volatility periods.

- Example: If you place a market order to buy a stock, the order will be filled at the best available price at that moment.

- Risk Considerations: Experienced traders may avoid market orders during periods of low liquidity or high volatility, as slippage (the difference between the expected price and the actual fill price) can lead to higher-than-expected costs.

Stop Orders:

- Usage: Stop-loss orders are critical for managing risk and protecting profits. By setting a stop order, traders can automate the exit of a trade when the market moves against them.

- Example: If a trader buys a stock at $100 and sets a stop-loss at $90, the stock will be automatically sold if the price falls to $90.

- Advanced Use: Experienced traders often use trailing stop orders to lock in profits. For instance, if a trader buys a stock at $100 and sets a trailing stop at $5, the stop order will move up with the stock price. If the price rises to $110, the stop order will be adjusted to $105, protecting profits.

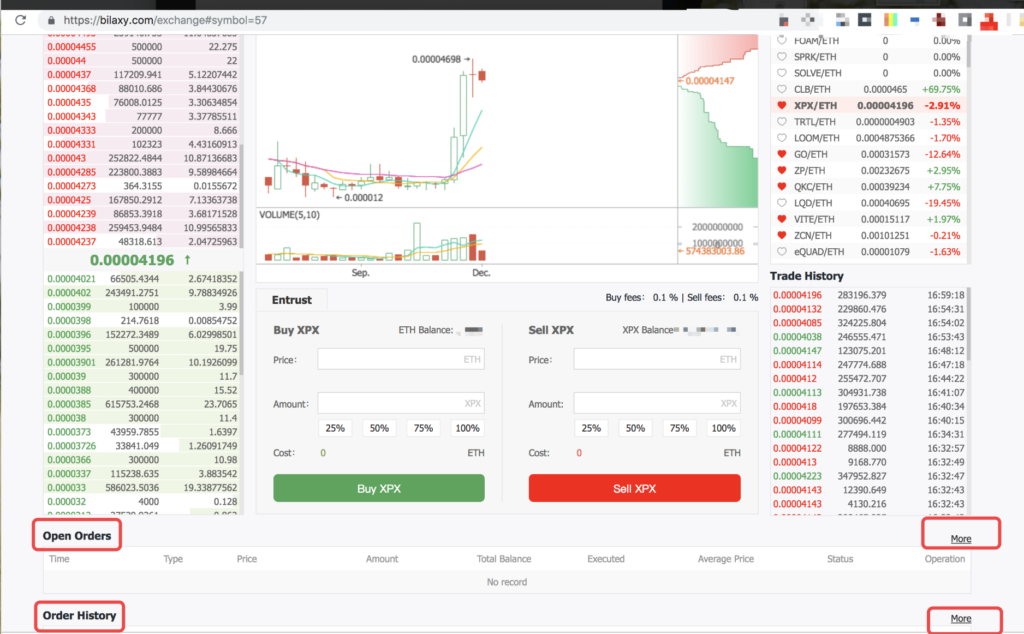

Good Til Canceled (GTC) Orders:

- Usage: These orders remain in effect until filled or manually canceled. GTC orders are useful when a trader has a target price that they believe the asset will reach over an extended period, but they don’t want to constantly monitor the market.

- Example: A trader places a buy limit order at $50 for a stock, but the stock is trading at $60. The GTC order will remain active until the stock reaches $50 or the trader cancels the order.

- Advanced Use: GTC orders can be combined with macroeconomic analysis, such as anticipating a pullback in a stock price after a major economic report is released.

Day Orders:

- Usage: Day orders are typically used by day traders who only want to execute trades within the current trading session and do not wish to carry positions overnight.

- Example: If a trader places a buy limit order at $100 for a stock during the day, the order is canceled if it is not filled before the market closes.

- Advanced Use: For more advanced strategies, day orders can be combined with news trading, where the trader enters a position just before key announcements, such as earnings reports or Federal Reserve meetings.

Managing Risks with Open Orders: Advanced Strategies

Understanding and mitigating risks is vital for successful trading. The main risks associated with open orders include slippage, partial fills, and market volatility. Let’s explore these risks in more detail and discuss strategies for managing them effectively.

Slippage:

Slippage occurs when the price at which an order is filled differs from the price at which it was placed. This is particularly common during periods of high volatility or low liquidity. For example, during major economic announcements such as a GDP report or interest rate decision, slippage can be significant due to the sudden surge in trading volume and price fluctuations.

Risk Mitigation:

- Limit Orders: The best way to avoid slippage is by using limit orders, which guarantee the price at which a trade is executed.

- Advanced Use: Experienced traders often combine slippage control with price action analysis. For example, placing a limit order at a price near a technical support or resistance level can help avoid slippage in volatile conditions.

- News Trading: During high-impact news events, such as the release of employment data or inflation reports, traders may opt for market orders with caution, being prepared for slippage due to price gaps or fast-moving markets.

Partial Fills:

Partial fills happen when only a portion of your order is executed. This typically occurs when there is insufficient liquidity at the price level set for the order.

Risk Mitigation:

- Smaller Orders: Break large orders into smaller ones to improve the chances of a full fill, especially when liquidity is low.

- Limit Orders: Use limit orders to control the price but keep an eye on liquidity levels. If you’re trading large volumes, consider placing several smaller orders at different price levels to minimize the impact of partial fills.

Market Volatility:

Market volatility can significantly impact the execution of open orders. Major news events, geopolitical developments, or unexpected economic reports can cause rapid price fluctuations.

Risk Mitigation:

- Use of Stop Orders: During volatile conditions, traders may set stop orders to automatically close positions when prices move too quickly in the wrong direction.

- Advanced Strategy: Experienced traders can incorporate multi-timeframe analysis to identify key support and resistance zones across different time periods. This approach helps determine optimal entry and exit points, reducing exposure to short-term volatility.

Advanced Trading Strategies for Experienced Traders

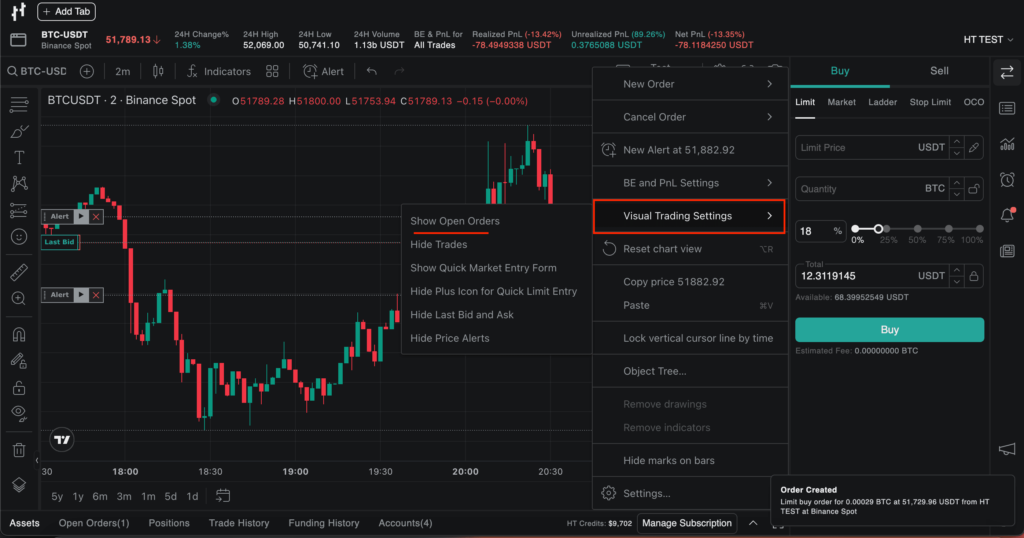

While the basic order types are essential for all traders, experienced traders often rely on more complex strategies, such as One-Cancels-the-Other (OCO) orders, to manage multiple positions simultaneously.

OCO Orders:

An OCO (One-Cancels-the-Other) order is a combination of two orders: a limit order and a stop order. When one of the orders is executed, the other is automatically canceled.

- Example: A trader might place an OCO order to buy a stock at $100 (limit) or to sell it at $90 (stop) if the stock moves against the position. This ensures that one of the orders is filled, while the other is canceled.

- Advanced Use: Experienced traders often use OCO orders when they expect the market to move in one direction but want to protect against adverse price movements. For instance, this could be applied before major earnings reports or when trading on market sentiment during high-impact news.

Multi-Timeframe Analysis:

Experienced traders often combine open orders with multi-timeframe analysis to optimize their entry and exit points. By analyzing multiple timeframes, traders can identify trends and price levels that may not be visible on a single timeframe.

- Example: A trader might use a 15-minute chart for short-term entries and a 4-hour chart for broader trend analysis. This allows them to place limit orders at optimal price levels while also factoring in broader market conditions.

- Advanced Use: Multi-timeframe analysis can be combined with technical indicators like moving averages and RSI to set up confluence zones for more accurate entries and exits.

Conclusion

Understanding open orders and how to manage them effectively is a vital skill for traders of all levels. For beginners, mastering basic order types such as limit and stop orders is essential. As traders gain experience, they can expand their toolkit with advanced strategies like OCO orders, multi-timeframe analysis, and managing risks during volatile conditions. By continuously refining their approach, traders can improve their risk management techniques, execute trades more effectively, and enhance their overall trading performance.

FAQ

What types of open orders can I place in the market?

There are several types of open orders you can place, including:

- Limit Order: A buy or sell order set at a specific price or better. It will only execute at that price or a more favorable one.

- Market Order: A buy or sell order that is executed immediately at the current market price.

- Stop Order (Stop Loss): An order placed to buy or sell once the price reaches a specified stop price, triggering a market order.

- Stop-Limit Order: Similar to a stop order, but once the stop price is reached, the order becomes a limit order instead of a market order.

- Trailing Stop Order: A stop order where the stop price adjusts as the market moves in your favor.

What is the difference between a limit order and a market order?

- Limit Order: A limit order is an order to buy or sell at a specific price or better. It guarantees the price, but there is no guarantee that the order will be filled. It will only be executed when the market reaches your specified price.

- Market Order: A market order is an order to buy or sell at the best available price in the market at the time the order is placed. It guarantees execution but does not guarantee the price, as it will be filled at the prevailing market rate, which could be different from the last quoted price.

How can I use stop orders to manage my risk?

top orders are useful tools for managing risk, particularly for limiting potential losses. A stop-loss order allows you to automatically sell an asset once its price falls to a certain level. This can help protect you from further losses if the market moves against your position. A stop-limit order provides more control, as it combines a stop order with a limit order, ensuring that you only sell at your specified price or better after the stop price is triggered.

What does "Good ‘Til Canceled (GTC)" mean, and how does it work?

A Good Til Canceled (GTC) order is an order that remains active until it is either executed or manually canceled by the trader. Unlike day orders, which automatically expire at the end of the trading day if not filled, GTC orders remain in place for days, weeks, or even longer, depending on the broker’s rules. This feature allows traders to set long-term price targets without needing to resubmit their orders daily.