The Forex market, or the Foreign Exchange Market, is a decentralized global marketplace where the currencies of different countries are bought and sold. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Forex-related terminology is crucial for anyone interested in trading currencies because the market operates 24 hours a day, five days a week, across multiple time zones, providing constant opportunities for profit or loss.

Unlike stock or bond markets, the Forex market has no central exchange, making it a highly dynamic environment. Currencies are traded in pairs, meaning that when you exchange one currency for another, you are simultaneously buying and selling. To navigate the forex lexicon effectively, traders need to understand key terms, strategies, and market nuances.

Importance of Forex in the Global Economy

Forex plays a critical role in the global economy. It facilitates international trade, as businesses around the world must exchange currencies to pay for goods and services. For example, a U.S.-based company purchasing machinery from Germany will need to convert U.S. dollars into euros. Similarly, central banks and governments use the Forex market to stabilize their national currencies, manage inflation, and influence domestic monetary policies.

The importance of foreign exchange terms becomes evident in these activities, as traders, businesses, and policymakers rely on accurate and timely information to make decisions. The currency market terms used in daily trading activities help ensure the smooth functioning of international finance.

Overview of Trading Pairs, Currency Conversion, and the Role of Brokers

Currency Pairs and Their Classifications

In Forex trading, currencies are always traded in pairs. This means that when you buy one currency, you are simultaneously selling another. For example, if you trade the EUR/USD pair, you are buying euros and selling U.S. dollars.

There are three main classifications of currency pairs:

- Major Pairs: These pairs involve the most traded currencies globally, and they typically offer the best liquidity and tightest spreads. Major pairs include EUR/USD, GBP/USD, and USD/JPY. These are the most commonly traded pairs because they represent strong economies and high trade volumes. The forex terminology related to major pairs is familiar to most traders and often forms the foundation of their trading strategies.

- Minor Pairs: These pairs consist of currencies from smaller economies or involve one major currency and one lesser-traded currency. For example, EUR/GBP or AUD/JPY. While still liquid, minor pairs tend to have slightly wider spreads and can be more volatile than the major pairs. Understanding the unique foreign exchange glossary associated with minor pairs is key to managing risk.

- Exotic Pairs: Exotic pairs involve one major currency and one from an emerging or smaller economy, such as USD/TRY (US Dollar/Turkish Lira) or EUR/SGD (Euro/Singapore Dollar). These pairs are often less liquid and have wider spreads due to lower trading volumes. Currency exchange vocabulary related to exotic pairs is important, as it allows traders to assess the risks and rewards of trading in these less familiar markets.

Base and Quote Currencies

Understanding currency pair terminology is essential for analyzing exchange rates. In a currency pair, the first currency is the base currency, and the second one is the quote currency.

- Base Currency: This is the currency listed first in the pair, and it represents the amount of the second currency needed to buy one unit of the base currency. For example, in the EUR/USD pair, the EUR is the base currency. If the exchange rate is 1.2000, it means that 1 Euro is equal to 1.20 U.S. Dollars.

- Quote Currency: The quote currency is the second currency in the pair and shows how much of this currency is needed to buy one unit of the base currency. Using the same example, if the EUR/USD exchange rate is 1.2000, 1 Euro is worth 1.20 USD.

Understanding the relationship between these two currencies is fundamental to analyzing market trends and making trading decisions. Forex language allows traders to communicate effectively about market movements and potential entry or exit points.

Bid/Ask Price and Spread

Another important concept in forex terminology is the bid/ask price and the spread.

- Bid Price: This is the price at which a trader can sell a currency pair. It’s the highest price that a buyer is willing to pay for a currency at any given time. For example, if the bid price for EUR/USD is 1.1950, a trader can sell at this price.

- Ask Price: The ask price is the price at which a trader can buy a currency pair. It’s the lowest price that a seller is willing to accept. For example, if the ask price for EUR/USD is 1.1953, a trader can buy at this price.

- Spread: The spread is the difference between the bid and ask prices. It represents the broker’s profit from the trade and is influenced by the liquidity of the currency pair. Major pairs like EUR/USD usually have smaller spreads, while exotic pairs tend to have wider spreads. A narrow spread is indicative of high liquidity, while a wider spread suggests lower liquidity.

Mastering trading jargon like bid, ask, and spread helps traders better manage transaction costs and evaluate the efficiency of their trades.

Types of Orders in Forex Trading

Understanding trading terms and expressions related to orders is essential for any trader. There are several different types of orders in Forex:

Market Order

A market order is one of the simplest order types in Forex. When a trader places a market order, they agree to execute the trade immediately at the current market price. Market orders are useful for traders who want to enter or exit a position quickly. However, because prices can fluctuate rapidly, the exact price at which the order will be executed may vary slightly from the quoted price.

Limit Order

A limit order is an instruction to buy or sell a currency pair at a specific price or better. Unlike a market order, a limit order is not executed immediately. It only gets filled when the market reaches the specified price. For example, if a trader wants to buy EUR/USD at 1.1900, they would place a limit order at that price. If the price reaches 1.1900, the order will be executed. Forex trading expressions related to limit orders help traders manage their entries into positions at favorable prices.

Stop Order (Stop-Loss)

A stop-loss order is used to automatically close a position to limit potential losses. This type of order is placed at a certain price level, and if the market reaches that price, the position is closed. For example, if you buy EUR/USD at 1.2000, you can set a stop-loss at 1.1900 to prevent further losses in case the market moves against you.

Take Profit

A take-profit order is placed to close a position once a specified level of profit is achieved. This order allows traders to lock in profits without constantly monitoring the market. For instance, if you bought EUR/USD at 1.2000, you could place a take-profit order at 1.2100, which would close your position once the price reaches your desired profit level.

Leverage and Margin in Forex Trading

Leverage

Leverage allows traders to control larger positions with a relatively small amount of capital. It is expressed as a ratio, such as 100:1 or 500:1, indicating the multiple of a trader’s capital that can be controlled in the market. For example, with 100:1 leverage, a trader with $1,000 can control up to $100,000 worth of currency.

While leverage can amplify profits, it also increases the potential for losses. Forex-related terminology like leverage and margin must be carefully understood, as using high leverage can quickly lead to significant losses if the market moves unfavorably.

Margin

Margin is the amount of money required to open a leveraged position. It is not a fee, but rather a security deposit held by the broker to ensure that the trader can cover any potential losses. The margin requirement depends on the size of the trade and the leverage ratio being used.

Margin Call

A margin call occurs when the value of a trader’s account falls below the required margin level due to adverse price movements. When this happens, the broker may require the trader to deposit additional funds to restore the margin balance. If the trader fails to meet the margin call, the broker may close their positions to limit further losses.

Pip, Point, and Tick in Forex

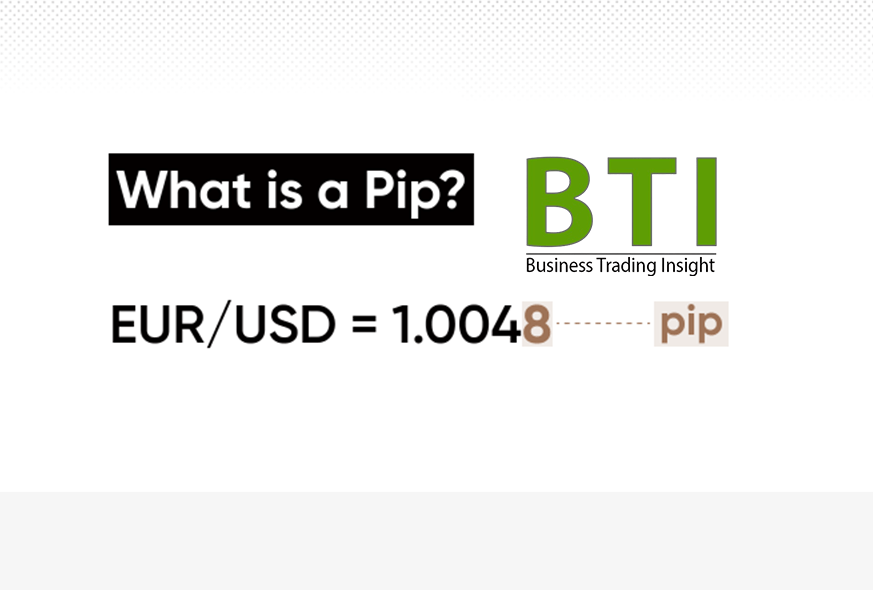

Pip

A pip (Percentage in Point) is the smallest price movement in the Forex market. For most currency pairs, a pip represents a movement of 0.0001. For example, if EUR/USD moves from 1.1150 to 1.1151, it has moved by one pip. Pips are essential for traders to measure the price changes in currency pairs and calculate profits or losses.

Point

A point is often used interchangeably with pip, but it can also refer to smaller movements, known as fractional pips or pipettes. In markets where currency market terms are used with fractional price movements, points allow for more precise price tracking.

Tick

A tick is the smallest possible movement in the price of any financial instrument. In Forex, a tick typically corresponds to a pip, but the term is more commonly associated with futures and commodities markets, where it refers to the smallest price fluctuation allowed in a contract.

For example, if the price of EUR/USD moves from 1.1150 to 1.1151, and each price change is the result of a single tick in the market, a tick represents a change of one pip. However, the concept of ticks is more commonly used in futures and commodities markets, where tick sizes and the value of each tick can vary depending on the instrument.

Types of Forex Analysis

Fundamental Analysis: Analyzing Economic Indicators, News Events, and Central Bank Policies

Fundamental analysis in Forex is the study of economic indicators, news events, and government policies that can affect currency values. This approach is rooted in the belief that currency prices are driven by macroeconomic factors such as GDP growth, inflation rates, interest rates, and employment figures. Traders who use this method aim to understand the economic landscape and its impact on currency pairs.

Key elements of fundamental analysis include:

- Economic Indicators: Metrics like employment data, inflation, and retail sales help gauge a country’s economic health and can influence the strength of its currency. These indicators are crucial for interpreting foreign exchange terms and determining the broader market sentiment.

- Interest Rates: Central banks control interest rates, and their decisions have a direct impact on currency values. Higher rates can attract foreign investment, strengthening the currency, while lower rates may weaken it. The influence of central bank policies is a key component of any foreign exchange glossary.

- Geopolitical Events: Political instability, international trade policies, and global events such as natural disasters or conflicts can cause sudden fluctuations in currency values. These are important factors in currency market terms that traders must monitor.

- Central Bank Policies: The actions and statements from central banks, such as the Federal Reserve or the European Central Bank, significantly influence currency prices. Changes in interest rates, monetary policy, or even forward guidance can create volatility in the forex market lexicon.

Fundamental analysis helps traders assess whether a currency is undervalued or overvalued, providing a basis for long-term trends and trading decisions.

Technical Analysis: Using Charts, Indicators, and Patterns to Predict Future Price Movements

Technical analysis focuses on price action and historical data to forecast future market trends. Unlike fundamental analysis, which is based on economic factors, technical analysis is centered around the price movement of a currency pair. It assumes that market sentiment and trends can be identified through patterns and chart indicators.

Key tools and concepts in technical analysis include:

- Charts: Various chart types, such as line charts, bar charts, and candlestick charts, help traders visualize price movements over time. These trading terms and expressions are essential for understanding market sentiment and predicting future market movements.

- Indicators: Tools like moving averages, the Relative Strength Index (RSI), and Bollinger Bands are used to gauge trends and potential market reversals. These indicators are part of the forex terminology that traders frequently encounter.

- Support and Resistance Levels: Key price levels that a currency pair has historically had difficulty breaking through. These levels are critical in determining entry and exit points for trades.

- Chart Patterns: Patterns such as head and shoulders, double tops, and triangles are used to identify potential price movements. Recognizing these forex trading expressions can help traders predict the future direction of currency pairs.

Technical analysis is often employed by short-term traders, such as scalpers or day traders, who focus on making quick trades based on small price movements.

Sentiment Analysis: Assessing Market Sentiment Based on Trader Behavior and Positioning

Sentiment analysis examines the overall market mood, often by studying trader positioning. This type of analysis helps traders gauge whether market participants are predominantly bullish or bearish on a particular currency pair. By understanding the prevailing sentiment, traders can predict potential price movements.

Tools used in sentiment analysis include:

- Commitment of Traders (COT) Reports: These reports offer valuable data on the positioning of large institutional traders, helping traders assess market sentiment. Understanding foreign exchange-related terminology in these reports can provide crucial insights into future trends.

- Sentiment Indicators: Some brokers offer tools that display the proportion of traders who are long versus short on specific currency pairs, providing an overview of the market terminology in use by the broader trading community.

- News and Events: Major events like economic data releases or geopolitical developments can shift market sentiment rapidly, influencing currency exchange vocabulary and changing market dynamics.

Sentiment analysis is especially useful for identifying potential market reversals or confirming ongoing trends, as it reveals the collective psychology of traders in the forex market.

Common Forex Trading Strategies

Scalping: Short-Term Trading Aimed at Small Price Movements

Scalping is a high-frequency trading strategy that involves making a large number of small trades over very short time periods, typically seconds to minutes. Scalpers focus on minor price discrepancies in highly liquid currency pairs. Since the profit per trade is minimal, traders rely on executing many trades throughout the day to accumulate significant gains.

Scalpers typically use technical analysis tools like moving averages, oscillators (e.g., RSI, Stochastic), and volume indicators to identify small price changes. They focus on currency pair terminology to spot opportunities where the spread is tight enough to generate profit without excessive transaction costs.

Day Trading: Opening and Closing Trades Within the Same Day

Day trading involves opening and closing positions within a single trading day, with no positions held overnight. This strategy relies on intraday price movements, and traders often look for opportunities based on breaking news, earnings reports, or economic data that might cause rapid price changes.

Day traders often use technical analysis tools like candlestick patterns, support and resistance levels, and momentum indicators to determine market terminology that indicates potential trade opportunities. The ability to react quickly to market conditions is crucial in day trading.

Swing Trading: Taking Advantage of Medium-Term Price Movements Over Several Days

Swing trading focuses on capturing medium-term price movements. Traders typically hold positions for a few days to several weeks, aiming to profit from price swings between support and resistance levels. This strategy combines both fundamental and technical analysis to identify potential market trends.

Swing traders might use tools like Fibonacci retracements, trend lines, and moving averages to understand currency market terms and identify potential turning points. Unlike day traders, swing traders are comfortable holding positions overnight or over the weekend to capture broader price movements.

Position Trading: Long-Term Trading Based on Fundamental Analysis

Position trading is a long-term strategy that involves holding trades for weeks, months, or even years. Traders using this strategy typically rely on fundamental analysis to determine the long-term direction of a currency pair, with a focus on macroeconomic factors such as interest rates, inflation, and GDP growth.

Position traders monitor currency exchange vocabulary and market terminology to understand the underlying forces shaping currency prices. Since position trading involves fewer trades, it requires patience and the ability to weather short-term market volatility.

Risk Management

Risk-to-Reward Ratio: The Potential Profit Versus Potential Loss in a Trade

The risk-to-reward ratio is a key concept in risk management, representing the amount of risk a trader is willing to take in relation to the potential reward. It is expressed as a ratio, such as 1:2, 1:3, or 1:4, where the first number represents the potential loss (risk) and the second number represents the potential profit (reward).

For example, if a trader risks 50 pips to make 150 pips, the risk-to-reward ratio is 1:3. Many traders aim for a ratio of at least 1:2, meaning they are willing to risk 1 unit of potential loss for every 2 units of potential profit. By maintaining a favorable risk-to-reward ratio, traders increase the probability of being profitable in the long run, even if they have a lower win rate.

The risk-to-reward ratio is a key part of an overall risk management strategy, helping traders determine where to place stop-loss and take-profit orders.

Stop-Loss Order: A Tool to Limit Potential Losses

A stop-loss order is an essential tool in risk management that allows traders to limit their potential losses on a trade. It is an order placed to automatically close a position once the price moves against the trader by a specified amount.

For example, if a trader buys EUR/USD at 1.1150 and places a stop-loss order at 1.1100, the position will automatically be closed if the price falls to 1.1100, limiting the loss to 50 pips. Stop-loss orders help protect traders from catastrophic losses in volatile or unexpected market conditions.

Stop-loss orders should be placed at strategic levels based on technical analysis, such as below a key support level for a buy order or above a key resistance level for a sell order. This ensures that the stop-loss is positioned in a way that doesn’t get triggered by minor price fluctuations.

Hedging: A Strategy to Offset Potential Losses in One Position by Taking an Opposite Position

Hedging is a risk management strategy used to reduce potential losses by opening a second position in the opposite direction of an existing position. The goal of hedging is to offset some or all of the potential losses in the primary trade.

For example, if a trader holds a long position in EUR/USD and is concerned about potential short-term volatility, they might take a short position in the same currency pair to reduce risk. Hedging is not about making a profit on the hedge itself but about protecting an existing position.

Hedging can be done in a variety of ways:

- Direct Hedging: Opening an opposing position on the same currency pair.

- Cross-Currency Hedging: Hedging a position in one currency pair with an unrelated pair that is correlated (e.g., hedging EUR/USD with GBP/USD).

Hedging strategies can be complex and involve costs, so traders need to evaluate whether the potential benefit outweighs the cost of the hedge. Some brokers also restrict or charge additional fees for hedging.

Forex Market Participants

Retail Traders: Individual Traders Engaging in the Forex Market via Brokers

Retail traders are individual investors who trade in the Forex market through brokers. These traders typically engage in Forex trading for speculative purposes, using their own capital to trade currency pairs. Retail traders can range from beginners to experienced professionals, but the vast majority are smaller players compared to institutional participants.

Retail traders usually access the market through online trading platforms provided by brokers. These platforms offer features like charts, technical analysis tools, and leverage, allowing individual traders to analyze the market and make informed decisions. While retail traders do not have the same financial resources as institutional traders, they can still participate in Forex by using leverage and taking advantage of market trends.

Institutional Traders: Banks, Hedge Funds, and Large Financial Entities

Institutional traders are large financial entities that trade in significant volumes in the Forex market. These include banks, hedge funds, multinational corporations, and other financial institutions. Institutional traders have far more capital and market influence than retail traders and often engage in Forex for purposes such as currency hedging, international trade settlements, and speculative trading.

Banks, in particular, are major players in the Forex market, as they facilitate currency transactions for businesses, governments, and clients, as well as engage in proprietary trading. Hedge funds use sophisticated strategies and algorithms to trade large volumes, often focusing on short-term gains. Institutional traders tend to have access to better pricing, more liquidity, and advanced research, making them formidable participants in the Forex market.

Market Makers: Brokers or Dealers Who Provide Liquidity by Quoting Both Bid and Ask Prices

Market makers are brokers or dealers who provide liquidity in the Forex market by quoting both a bid price (the price at which they will buy a currency pair) and an ask price (the price at which they will sell a currency pair). Market makers profit from the spread, which is the difference between the bid and ask prices, and they help ensure that there is always a buyer and seller available for each currency pair.

Market makers are essential for the smooth functioning of the Forex market, as they provide continuous liquidity, especially in less-traded currency pairs. They play a key role in reducing the volatility and price gaps that can occur when liquidity is low. However, retail traders should be cautious when dealing with market makers, as they might have a conflict of interest, especially if they are trading against the market maker’s position.

Central Banks: Entities That Influence Forex Through Monetary Policy

Central banks are national institutions responsible for managing a country’s monetary policy, controlling inflation, and stabilizing the currency. Central banks, such as the Federal Reserve (USA), the European Central Bank (ECB), and the Bank of Japan (BoJ), influence the Forex market by adjusting interest rates, engaging in open market operations, and implementing other monetary policies.

Central banks intervene in the Forex market to stabilize the national currency, either by directly buying or selling their currency or by changing interest rates. For example, when a central bank raises interest rates, it can attract foreign investment, which strengthens the currency. Conversely, lower interest rates can weaken a currency. Central bank actions are closely watched by traders, as they can lead to significant market movements. Central banks also provide forward guidance on future monetary policy, which helps traders anticipate currency movements.

Conclusion on the Article: Forex Trading Guide for Beginners

This article provides a well-rounded and comprehensive introduction to the world of Forex trading. It successfully covers the fundamental concepts that every beginner needs to understand, from basic terminology to more advanced strategies. The structure of the article is clear and organized, making it easy for readers to follow and absorb key concepts at their own pace.

Strengths of the Article:

- Thorough Overview of Key Concepts: The article covers essential topics like currency pairs, spread, leverage, and margin, which are critical to understanding how the Forex market operates. By explaining basic concepts such as bid/ask price, pip, and point, the article ensures that beginners have a solid foundation before diving into trading strategies.

- Clear Explanation of Trading Tools and Orders: The inclusion of different types of orders (market, limit, stop-loss, and take-profit) is crucial for beginner traders, as it allows them to better understand how to execute trades and manage positions effectively. These basic tools are the building blocks of any trading strategy, and their clear explanations help demystify the trading process.

- Comprehensive Overview of Analysis Methods: The article discusses fundamental analysis, technical analysis, and sentiment analysis, giving beginners a broad understanding of the different ways traders approach the market. This balanced approach enables readers to appreciate both quantitative (technical) and qualitative (fundamental and sentiment) factors in decision-making.

- Risk Management: It provides an important section on risk management, emphasizing critical concepts like risk-to-reward ratio, stop-loss orders, and hedging. This is an area where many new traders struggle, and this guide highlights its importance in safeguarding capital.

- Insight into Market Participants: By explaining the roles of retail traders, institutional traders, market makers, and central banks, the article gives a deeper understanding of how the Forex market operates and who the key players are. This section helps contextualize the reader’s role in the larger market ecosystem.

Areas for Improvement:

- More Practical Examples: While the article covers many theoretical concepts, adding more practical, real-life examples would be beneficial. For instance, including specific trading scenarios showing the execution of stop-loss or take-profit orders in various market conditions would help readers connect the theory to real trading situations.

- Interactive Elements and Visuals: The article could be further enhanced with charts, graphs, or even interactive diagrams to visually demonstrate concepts like pip calculations, chart patterns, and price movements. Visual learning aids would improve comprehension, especially for beginners who are new to the market.

- Further Depth in Advanced Topics: While the article does a great job of introducing fundamental concepts, advanced topics such as algorithmic trading, trading bots, or cryptocurrency pairs could be briefly mentioned to reflect current market trends. This would provide readers with a broader perspective of the Forex market’s evolving landscape.

- Detailed Risk Management Strategies: Although risk management is addressed, more in-depth strategies could be explored. For example, explaining how to use position sizing, diversification, or correlation of currency pairs in managing risk would offer valuable insights for traders looking to reduce exposure to losses.

- Clearer Segmentation of Content: The article covers a wide range of topics, but further segmentation with clearer headings for each subsection (e.g., sub-headings under risk management such as “Types of Risk Management Tools” or “Advanced Risk Management Strategies”) would make the article easier to navigate and ensure that readers can quickly find the information they need.

Final Assessment:

Overall, this article provides an excellent starting point for anyone new to Forex trading. It introduces core concepts clearly and concisely, covers the essentials of trading strategies, and offers valuable information on how to manage risk. With a few additional practical examples and visual aids, it could become an even more powerful resource for beginner traders.

The article serves as a solid foundation for anyone looking to get started in the Forex market, and with some updates to reflect more current trends and practices, it could also cater to those who are progressing beyond the basics. For beginners, this guide is a strong and informative starting point in their trading journey.

Overall Conclusion: The article is highly informative and well-structured, making it a highly useful resource for beginners, but with potential for improvement in providing practical applications and deeper insights into advanced strategies.