In the world of trading, whether in the stock market, forex, or cryptocurrency markets, managing risk is crucial for safeguarding capital and ensuring profitability in the long run. One of the most common tools used for managing risk is the stop loss order. A stop loss order automatically closes a trader’s position if the price of an asset moves against them by a pre-defined amount, protecting the trader from further losses.

However, while stop losses are designed to protect traders, they can sometimes become the target of manipulation by large institutional players, high-frequency trading (HFT) algorithms, or even market makers. This practice is known as stop loss hunting — a strategy where market participants deliberately move prices to trigger stop orders in order to profit from the price movements that follow.

In this article, we will explore the mechanisms and causes of stop loss hunting, the impact it has on market participants, and strategies that traders can use to protect themselves from this type of market manipulation. We’ll also discuss how specific technical indicators like the gravestone doji candlestick can help identify market conditions conducive to stop loss hunting.

What is Stop Loss Hunting?

General Description of the Concept

Stop loss hunting refers to the intentional manipulation of the price of an asset to trigger stop loss orders placed by other traders, usually retail traders. These stop loss orders are often set at key support and resistance levels, at round numbers, or just below recent highs or lows. Large institutional players or algorithms that have the ability to place significant market orders can «push» the price to these levels, triggering a cascade of stop orders. Once the stop losses are triggered, the price often reverses, and traders who were stopped out at these levels end up losing money.

The essence of stop loss hunting is that large players profit from these price movements by creating artificial volatility — a situation where the price moves sharply in one direction, triggering stop loss orders, and then moves back in the opposite direction once the stop orders have been filled.

Importance of the Topic for Traders, Investors, and Financial Market Regulators

Understanding stop loss hunting is of critical importance for traders, investors, and financial market regulators. For traders, particularly retail traders, being aware of the possibility of stop loss hunting allows them to implement smarter trading strategies that reduce the likelihood of falling victim to manipulation.

For institutional investors and traders, the phenomenon highlights the risks associated with overly relying on stop loss orders, especially in volatile or low-liquidity markets. Finally, for financial regulators, stop loss hunting raises concerns about the integrity of the market. Manipulating prices to trigger stop orders undermines the efficiency and fairness of the market, which can erode trust among market participants and lead to increased market instability.

Objective of the Article

The primary objectives of this article are:

- To understand the mechanisms and causes behind stop loss hunting.

- To explore how it affects different market participants, particularly retail traders.

- To provide strategies for traders to protect themselves against manipulation by large players and algorithms.

- To examine the role of technical analysis tools, such as the gravestone doji candlestick, in recognizing potential stop loss hunting scenarios.

By the end of this article, you will have a comprehensive understanding of stop loss hunting and practical insights on how to safeguard your trades from this type of manipulation.

Relevance of the Topic

As financial markets become increasingly dominated by high-frequency trading (HFT) and sophisticated algorithms, the risk of stop loss hunting has grown. Large institutional players and HFT algorithms have the ability to move the market in ways that create temporary price fluctuations, allowing them to profit from triggering stop orders placed by less experienced or smaller traders. As these forces become more pronounced in global markets, understanding how stop loss hunting works and how to protect against it becomes even more relevant for traders and investors alike.

The Basics: What is a Stop Loss?

Definition of Stop Loss

A stop loss is an order placed with a broker to buy or sell an asset once the price reaches a certain predetermined level. The purpose of the stop loss is to limit a trader’s potential losses on a position. For example, if a trader buys a stock at $100 and places a stop loss at $90, the position will be automatically sold when the stock price drops to $90, limiting the trader’s loss to $10 per unit.

Stop loss orders differ from other types of orders, including:

- Take profit orders: These are used to close a position when a certain profit level is reached.

- Limit orders: These specify a price at which a trader is willing to buy or sell an asset, but they do not guarantee execution.

- Market orders: These are executed immediately at the best available price in the market.

The Role of Stop Losses in Risk Management and Capital Protection

Stop losses play a critical role in risk management, particularly for retail traders who do not have the ability to monitor the market 24/7. By setting a stop loss, traders can define the maximum loss they are willing to accept on a trade, which helps them avoid emotional decision-making and prevent significant drawdowns in their trading accounts. Without stop losses, traders could face substantial losses in volatile markets.

By setting a stop loss, traders can also use position sizing as a method of controlling risk. For instance, if a trader is willing to risk only 2% of their capital on any single trade, they can calculate the appropriate position size based on the distance from their entry point to their stop loss level.

Types of Stop Loss Orders

There are several types of stop loss orders:

- Standard Stop Orders: These are the most basic type of stop loss. When the price reaches the stop level, the order is executed at the best available price in the market.

- Trailing Stop Orders: These orders adjust the stop loss level dynamically as the price moves in the trader’s favor. For example, if a trader sets a trailing stop order at a distance of 10% below the market price and the price increases, the stop loss level will automatically rise with the price. Trailing stops are particularly useful in trending markets.

- Protective Stop Losses in Volatile Markets: In highly volatile markets, traders may place wider stop losses to account for rapid price fluctuations. These stop losses help prevent being stopped out prematurely due to short-term market noise.

Applying Stop Losses in Trading Strategies

Stop losses are integral to both short-term and long-term trading strategies. For instance, in technical analysis, traders often place stop losses below key support levels in a long position or above resistance levels in a short position. These levels are considered areas of price stability, and the assumption is that if these levels are broken, the price will likely continue in the opposite direction.

Example: If a trader enters a long position at $100, and there is strong support at $95, the trader might place their stop loss at $94 to protect against a potential breakdown below that support level.

What is Stop Loss Hunting?

Definition of Stop Loss Hunting

Stop loss hunting is the act of deliberately manipulating the price of an asset to trigger stop loss orders that have been placed by other traders. This is typically done by large market participants such as institutional investors, hedge funds, or high-frequency trading algorithms, who can execute large orders capable of moving the market. Once the stop losses are triggered, the market often reverses, and the manipulators profit from the ensuing price movement.

The strategy behind stop loss hunting is simple: by moving the price through a concentration of stop loss orders, a manipulator can cause a chain reaction that triggers additional sell or buy orders, amplifying the price movement in their favor.

Types of Manipulation

- Liquidity Concentration: Stop loss hunting typically targets areas where there is high liquidity, such as around round numbers, major support and resistance levels, or areas where multiple traders have likely placed their stop loss orders.

- Artificial Price Movements: Manipulators use large orders to move the price through key levels, triggering a wave of stop losses. After the stop losses are triggered, the price often reverses, and the manipulator can profit from the price move.

Psychology of Stop Loss Hunting

The psychology behind stop loss hunting is rooted in crowd behavior. Many traders, especially less experienced retail traders, tend to place their stop losses at similar levels. These levels are often at round numbers, near recent highs or lows, or just beyond significant support or resistance areas. This predictability makes it easier for market manipulators to target these levels, creating artificial price movements that trigger stop orders.

The market also tends to behave in herd-like behavior. If a large number of stop losses are triggered in a short period, the price may accelerate in the direction of the manipulation, further encouraging additional stop orders to be filled.

Why Does Stop Loss Hunting Happen?

Large Market Participants

Institutional traders, hedge funds, and market makers are the primary participants behind stop loss hunting. These entities can manipulate the market because they have substantial resources, including capital and the ability to execute large orders. Their goal is often to profit from short-term price fluctuations by triggering stop losses and riding the resulting price movements.

Markets with Low Liquidity

Stop loss hunting is more likely to occur in markets with low liquidity, where the price can be moved more easily. In these markets, a single large order can push the price far enough to trigger a large number of stop losses, making the market more susceptible to manipulation. This is especially true in off-hours when trading volume is lower, such as during the night in the forex market or during holidays.

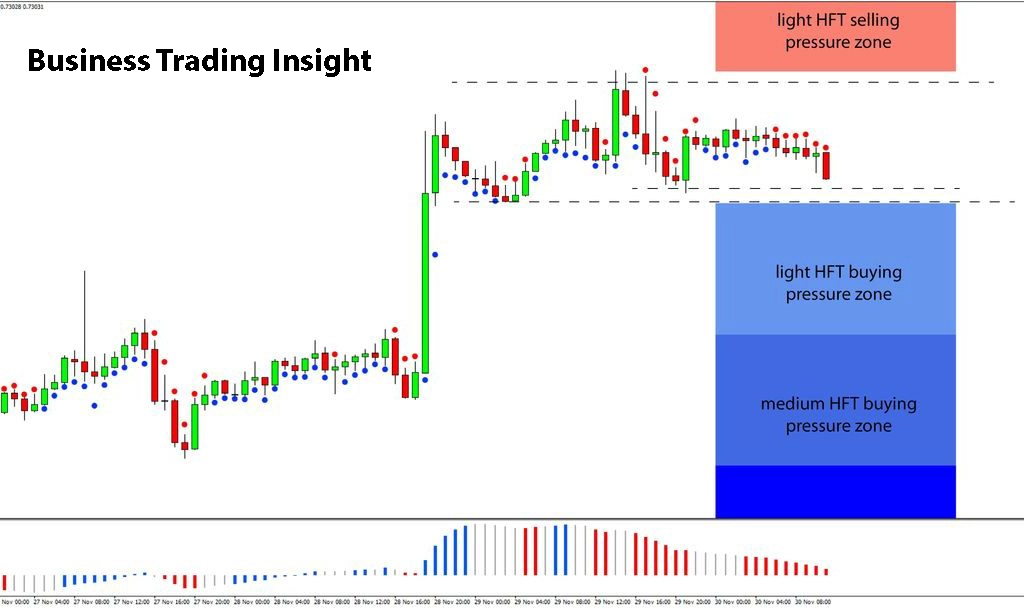

Impact of Algorithmic Trading and HFT

High-frequency trading (HFT) algorithms are designed to exploit small price inefficiencies in the market by executing thousands of trades in a fraction of a second. These algorithms can identify key levels where stop losses are likely to be placed and quickly execute large orders to trigger these stop losses. This creates a feedback loop where the market moves sharply, triggering additional stop orders and creating further price movement. As a result, HFT traders can capitalize on the market’s reaction to stop loss hunting.

Increased Volatility and Trends

Stop loss hunting often occurs during periods of increased market volatility, such as during major news events, economic reports, or changes in market sentiment. Sharp price movements during these times can trigger stop orders, leading to further volatility. Additionally, manipulative players may look for an established trend in the market and target stop losses placed against that trend. For example, if a currency pair is in a strong uptrend, stop loss hunting may target stop orders placed below key support levels, triggering further upward price movement as stop orders are filled.

Psychology and Behavior of Traders

The vulnerability to stop loss hunting is rooted in the psychology of traders. Many traders, especially retail traders, place stop losses at commonly observed levels, such as round numbers or near technical support or resistance. This behavior makes these levels predictable targets for market manipulators. Furthermore, when stop losses are triggered, the resulting price movement often creates a self-fulfilling prophecy, as other traders adjust their positions to align with the new trend, amplifying the price move.

How Does Stop Loss Hunting Work? Mechanisms and Examples

How Are Levels for Stop Loss Hunting Formed?

Certain price levels—such as round numbers, recent highs or lows, and well-established support and resistance zones—tend to attract a concentration of stop loss orders. These levels are vulnerable to manipulation because traders often place their stop orders in a predictable manner. When large players or algorithms push the price through these levels, they trigger a cascade of stop orders, resulting in a sharp price movement.

Role of Liquidity and Trading Volume

Low liquidity and trading volume can make stop loss hunting easier. When market volume is low, it takes fewer trades to move the price significantly. Market makers and large players can exploit this by executing large buy or sell orders to push the price through key levels, triggering stop orders.

Conclusion

Stop loss hunting is a manipulative practice that poses significant risks for retail traders and can contribute to increased market volatility. Understanding how it works and the factors that contribute to its occurrence, including market psychology, liquidity, and the actions of large institutional players, is crucial for traders looking to protect their capital. By applying smart risk management techniques, such as using trailing stops, setting stop losses at less predictable levels, and leveraging technical indicators like the gravestone doji candlestick, traders can reduce their vulnerability to stop loss hunting and navigate the complexities of modern financial markets more effectively.

FAQ

Who is responsible for Stop Loss Hunting?

Large institutional traders, hedge funds, and market makers are typically responsible for stop loss hunting. These entities have substantial capital and can execute large orders that impact the market. High-frequency trading (HFT) algorithms are also a common culprit, as they can identify price levels where stop losses are likely to be placed and quickly move the market to trigger them.

How can I protect my trades from Stop Loss Hunting?

To protect your trades from stop loss hunting, consider the following strategies:

- Set Stop Losses Strategically: Avoid placing stop losses at obvious levels, such as round numbers or common support and resistance zones. Instead, set them slightly beyond these levels to make it harder for manipulators to target them.

- Use Trailing Stops: Trailing stops move with the price, offering more flexibility as the market moves in your favor. This can help avoid being stopped out prematurely in volatile markets.

- Adjust for Market Liquidity: In illiquid or volatile markets, consider using wider stop losses to avoid being caught by short-term price fluctuations.

- Monitor Market Volume: Low volume can make the market more susceptible to manipulation. Be cautious during times of low liquidity, such as during off-hours or market holidays.

What role does market psychology play in Stop Loss Hunting?

Market psychology plays a key role in stop loss hunting. Many traders, particularly less experienced ones, tend to place stop losses at predictable levels, such as near round numbers or technical support and resistance zones. This predictable behavior makes these levels attractive targets for manipulators. Once stop losses are triggered, the price often accelerates in the direction of the manipulation, encouraging further traders to adjust their positions and reinforcing the price movement.

What are the typical levels targeted in Stop Loss Hunting?

Stop loss hunters often target key levels where many stop orders are likely to be placed, such as:

- Round numbers (e.g., 1.2000 in forex or $100 in stocks).

- Recent highs or lows, where many traders place stop losses just beyond these levels.

- Support and resistance zones, which are often areas where many traders expect the price to reverse.