Wedge patterns are a crucial aspect of technical analysis in trading, often indicating potential price reversals. Among these patterns, the falling wedge pattern stands out due to its distinct characteristics and implications for traders. In this article, we will delve into what a wedge is, its significance in trading, and explore both rising and falling wedge patterns in detail.

What Is a Wedge?

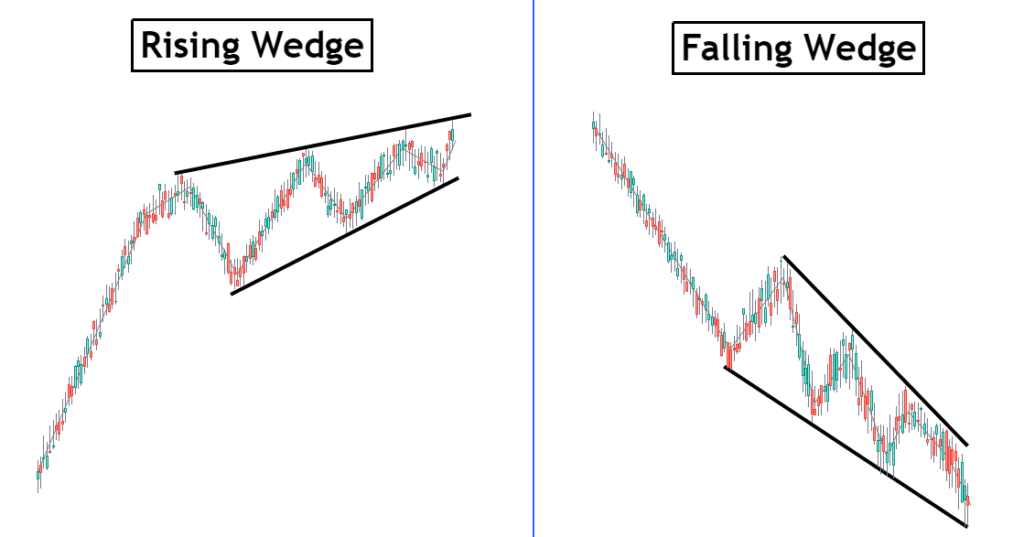

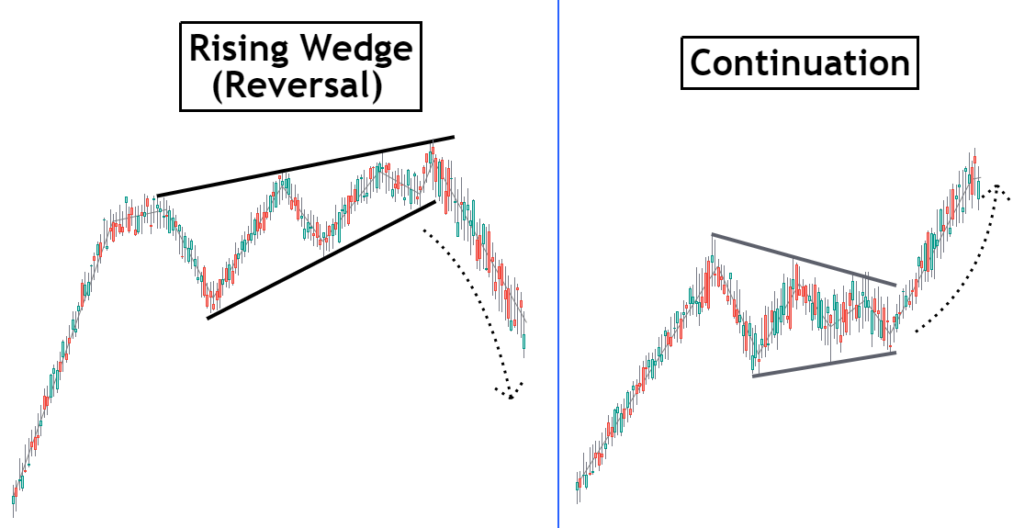

A wedge is a technical chart pattern that signifies a potential trend reversal or continuation in the market. It is characterized by two converging trend lines, which either slope upwards (rising wedge) or downwards (falling wedge). These patterns are formed over time as the price moves within the confines of the trend lines.

General Characteristics

Wedge patterns are typically formed over several price bars, reflecting a tightening price range. The key components include:

- Trend Lines: The upper and lower boundaries formed by the price movements.

- Convergence: As the pattern develops, the price action narrows, indicating indecision in the market.

- Duration: Wedges can appear over various timeframes, from minutes to weeks, providing insights for both day traders and long-term investors.

Importance in Trading

For traders and investors, wedge patterns are significant because they can signal potential reversals. Identifying these patterns early allows traders to position themselves advantageously before a significant price movement occurs. Moreover, understanding wedges helps in managing risk, as they provide clear entry and exit points.

Wedge Formation

Wedge patterns are formed through a series of price movements that reflect either accumulation or distribution. In a rising wedge, prices make higher highs and higher lows, but the upward momentum weakens. In contrast, a falling wedge showcases lower lows and lower highs, indicating a potential reversal to the upside.

Timeframe Considerations

Wedges can form in various timeframes:

- Short-Term: These are quick formations that can last from a few minutes to a few days, often providing immediate trading opportunities.

- Long-Term: Longer formations can span weeks or months, indicating more substantial market sentiment shifts.

Traders should consider the timeframe in their analysis, as the implications of a wedge may vary significantly based on the duration of its formation.

Market Psychology

The psychology behind wedge formations is essential to understanding their implications. In a rising wedge, traders may initially exhibit bullish sentiment, but as the pattern develops, a shift occurs towards caution. Conversely, in a falling wedge, the ongoing downward pressure may eventually lead to a bullish reversal, reflecting a shift in sentiment as buyers start to step in.

Common Indicators

Traders often use various technical indicators alongside wedge patterns to enhance their analysis. Some of these indicators include:

- Volume: Analyzing volume can help confirm the strength of the pattern.

- Relative Strength Index (RSI): This momentum oscillator can indicate overbought or oversold conditions.

- Moving Averages: These can provide context regarding the overall trend, complementing the wedge analysis.

Rising Wedge

A rising wedge is characterized by two upward-sloping trend lines that converge as the price moves higher. This pattern indicates that while the price is rising, the momentum is weakening, which can lead to a reversal.

Characteristics

Trend Direction

In a rising wedge, the price consistently makes higher highs and higher lows. However, the pace of the upward movement diminishes, suggesting a potential shift in market sentiment from bullish to bearish.

Volume Trends

Typically, volume may decrease during the formation of a rising wedge. A decline in volume can indicate that the buying pressure is weakening, further supporting the bearish implications of this pattern.

Interpretation

Bearish Implications

The rising wedge is generally considered a bearish pattern. Once the price breaks below the lower trend line, it can indicate a strong reversal, suggesting that sellers may take control of the market.

Potential Price Targets

After identifying a rising wedge, traders often set price targets based on the height of the pattern. This is typically measured from the highest point of the wedge to the lowest point at the breakout.

Examples

Real-world examples of rising wedges can often be found in stock charts of companies that have recently experienced significant upward movements, only to face strong selling pressure as the pattern forms. For instance, a technology stock that has been in a bull run may show a rising wedge as market sentiment shifts.

Falling Wedge

The falling wedge is a bullish pattern characterized by two downward-sloping trend lines that converge as the price declines. Unlike the rising wedge, the falling wedge indicates a potential reversal to the upside.

Characteristics

Trend Direction

In a falling wedge, the price makes lower lows and lower highs. This pattern signifies a slowdown in the downward momentum, often leading to a bullish breakout.

Volume Trends

During the formation of a falling wedge, volume often increases as the price approaches the apex of the pattern. A spike in volume during the breakout can validate the strength of the reversal.

Interpretation

Bullish Implications

The falling wedge is typically seen as a bullish pattern. When the price breaks above the upper trend line, it often leads to a significant upward movement, indicating that buyers have taken control.

Potential Price Targets

Traders usually set price targets after identifying a falling wedge by measuring the height of the pattern from the highest point to the lowest point and projecting that distance upward from the breakout point.

Examples

Falling wedges can be observed in various market conditions, often following significant downtrends. For instance, a commodity that has seen a prolonged decline may form a falling wedge, signaling a potential recovery as buying interest begins to return.

Benefits of Wedge Patterns

Wedge patterns possess strong predictive power, helping traders anticipate market movements. The convergence of trend lines signifies indecision among market participants, making the breakout direction critical for forecasting future price action.

Risk Management

Wedges can assist traders in managing risk effectively. By identifying clear entry and exit points, traders can establish stop-loss orders to protect against adverse movements. This strategic approach can minimize losses and enhance overall trading performance.

Combining with Other Strategies

Wedge patterns can be integrated with various trading strategies for improved effectiveness. Traders often combine them with indicators like moving averages or oscillators to confirm signals. Additionally, using wedges in conjunction with support and resistance levels can provide a more comprehensive analysis.

Real-Life Trading Applications

Many successful traders incorporate wedge patterns into their trading plans. For instance, a trader might use a falling wedge to identify a potential entry point while simultaneously analyzing volume and other indicators to confirm the bullish signal.

Summary

Wedge patterns, particularly the falling wedge pattern, are essential tools in a trader’s arsenal. Their ability to signal potential reversals, combined with effective risk management strategies, makes them invaluable for both novice and experienced traders. By understanding the nuances of these patterns, traders can better navigate the complexities of the market.

Identifying wedge patterns requires practice and keen observation. As you develop your trading strategy, consider incorporating wedge patterns into your analysis. Doing so can enhance your ability to predict market movements and make informed trading decisions. With patience and diligence, you can leverage the power of wedge patterns to improve your overall trading success.