The financial landscape is vast and includes numerous platforms and mechanisms for trading and investment. One of the most intriguing yet often misunderstood areas is the over-the-counter (OTC) market. Unlike traditional exchanges, where trades are conducted centrally, OTC markets facilitate direct trading between parties, offering unique opportunities and challenges. In this article, we will explore the intricacies of OTC markets, their significance in the financial system, the types of securities available, and strategies for successful investing in this complex area.

What is the OTC Market?

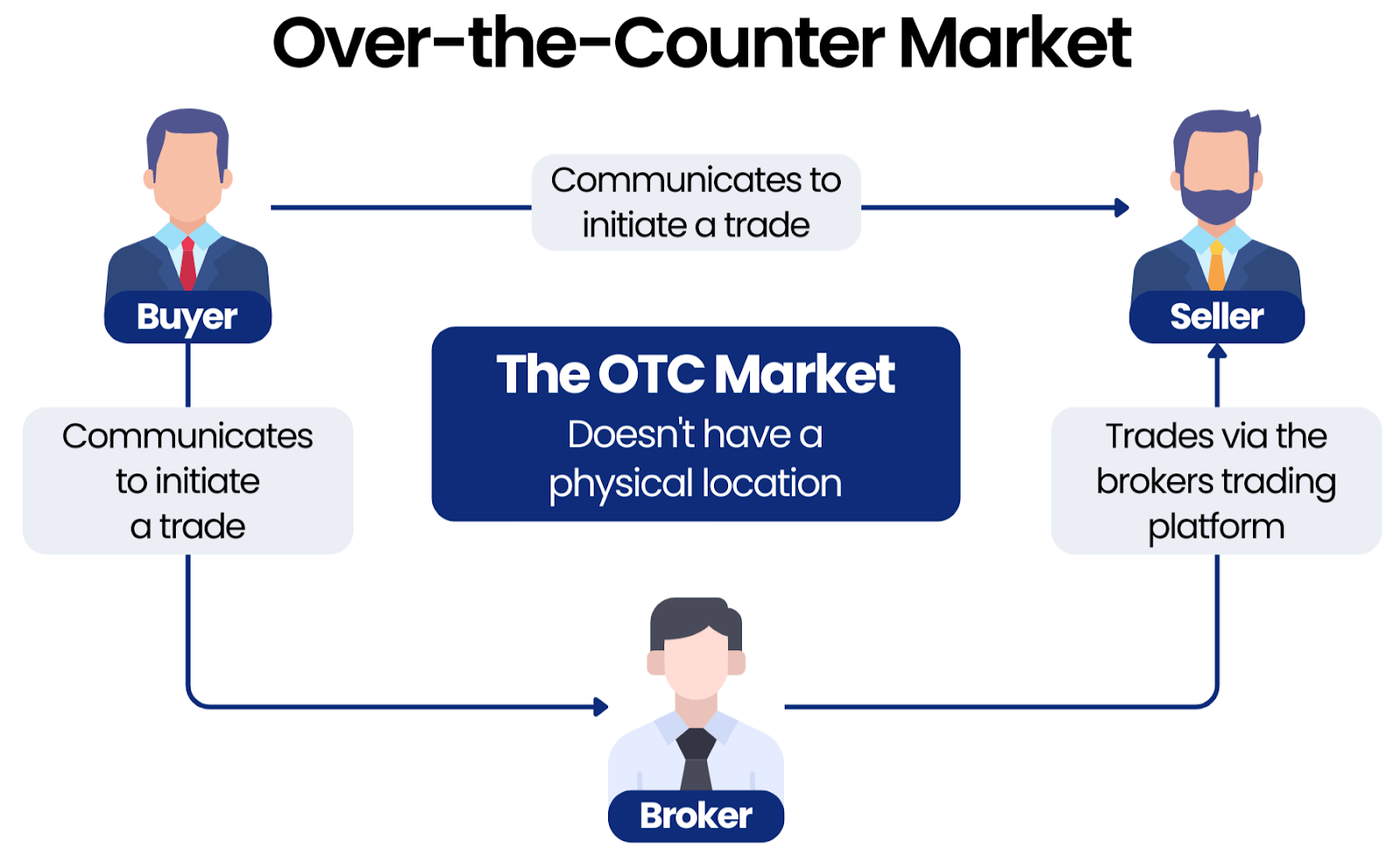

The OTC market is a decentralized platform where financial instruments are traded directly between two parties, bypassing a centralized exchange. This makes the OTC market critically important for many assets that do not meet the listing requirements of traditional exchanges. For example, startups or companies in the early stages of growth often utilize the OTC market to attract investment, as their financial performance may not meet the stringent standards of exchanges.

Key Characteristics of OTC Markets

- Decentralization

The absence of a central exchange allows participants to trade more flexibly. In traditional exchanges, trades are standardized and conducted according to fixed rules, which can limit traders’ opportunities. In OTC markets, participants can negotiate specific terms of a transaction, enabling customized contracts. This is particularly beneficial for complex financial products or non-standard volumes. - Direct Transactions

In the OTC market, trades occur directly between buyers and sellers. This not only simplifies the process but also fosters closer business relationships. Direct negotiations allow participants to discuss deal details such as price, volume, and execution conditions, potentially leading to more favorable agreements. - Variety of Instruments

OTC markets offer a wide range of financial instruments, including stocks, bonds, derivatives, and currencies. This variety allows investors to find unique opportunities that may not be available on traditional exchanges. For example, some specialized derivative instruments may only be accessible through OTC transactions.

Main Differences from Traditional Exchange Trading

| Parameter | OTC Markets | Traditional Exchanges |

| Regulation | Less regulation, increased risks | Strict regulation and investor protection |

| Liquidity | May be low due to smaller trading volumes | High liquidity due to centralized nature |

| Pricing Mechanisms | Prices are often negotiated, more subjective | Auction model with clear price formation |

Decentralized Trading of Over-the-Counter Markets

Decentralized Trading is a fundamental characteristic of Over the Counter markets, allowing for a more flexible and personalized trading experience. This feature makes OTC markets particularly attractive for those seeking alternative investment methods.

Mechanisms of Decentralized Trading

- Market Makers

Market makers are financial institutions or individual traders that provide liquidity in the market by quoting both buy and sell prices for various securities. Their primary function is to ensure that there is always a counterparty available for trades, which in turn helps stabilize prices and minimize market fluctuations. - Negotiated Transactions

The OTC market allows parties to freely negotiate the terms of a deal, including price, volume, and execution date. This can be especially useful in times of high volatility, where participants can adapt their trades to current market conditions. Flexibility in deal terms can lead to more favorable outcomes for both parties. - Electronic Platforms

Modern OTC transactions are often conducted through electronic trading platforms that connect buyers and sellers. These platforms significantly enhance trading efficiency by providing participants with access to real-time data and opportunities for quicker and more convenient transactions.

Advantages and Disadvantages of Decentralized Trading

Advantages:

- Flexibility

The ability to customize the terms of a transaction provides traders with significant advantages, especially in times of financial market instability. For example, in the case of a merger or acquisition, parties can easily agree on unique terms. - Access to Niche Markets

Over the Counter markets often provide access to securities not listed on traditional exchanges. This gives investors the opportunity to invest in startups or innovative products that may have high growth potential but low liquidity.

Disadvantages:

- Lack of Transparency

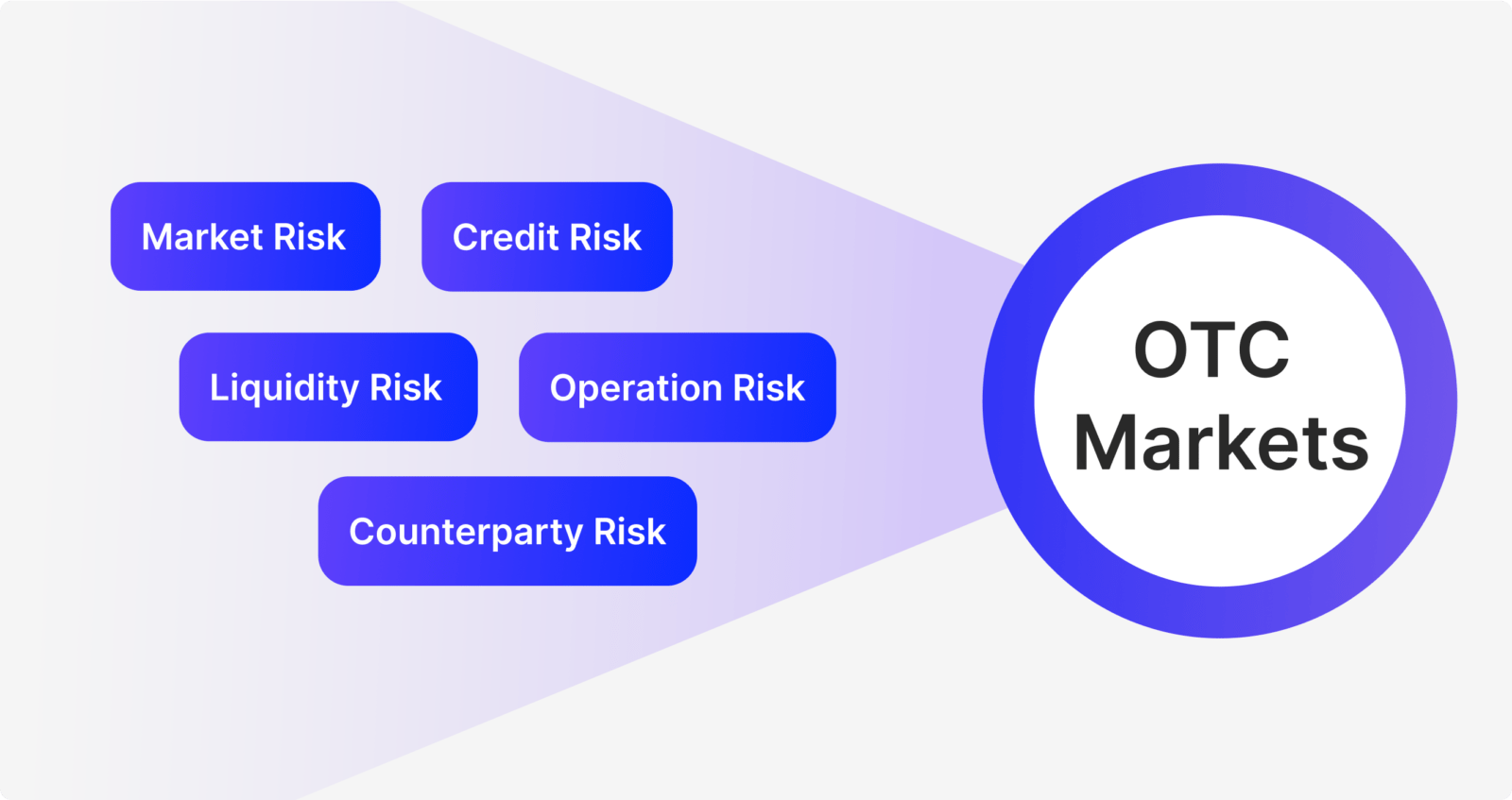

The decentralized nature of OTC markets can lead to a lack of transparency, making it difficult to assess the true market value of securities. Investors may face challenges in analyzing risks and opportunities. - Counterparty Risk

In the absence of a central clearinghouse, the risk that one party may default on a transaction is higher. This can lead to significant losses for investors, especially in the case of large deals.

Types of OTC Securities

OTC markets are home to a diverse range of securities, each with its unique characteristics and appeal.

Overview of Various Types of OTC Instruments

- Derivatives

These financial instruments derive their value from an underlying asset (such as stocks, bonds, or commodities) and allow investors to hedge risks or speculate on price movements. Examples include options, swaps, and forward contracts. OTC derivatives may offer more flexible terms compared to their exchange-traded counterparts, allowing traders to better tailor them to their needs. - Bonds

The OTC market is also home to many corporate and government bonds. While they are considered safer investments compared to stocks, their returns depend on the creditworthiness of the issuer. Investors should carefully evaluate the financial performance of companies before purchasing their bonds. - Foreign Currency

The foreign exchange (forex) market is primarily an Over the Counter market. Here, currencies are traded directly between participants, allowing companies engaged in international trade to effectively hedge currency risks and manage their assets. - Cryptocurrencies

The growing popularity of digital currencies has significantly transformed the OTC trading landscape. Investors can buy and sell cryptocurrencies on OTC markets at more favorable prices, especially in large transactions, where price fluctuations on public exchanges can be substantial.

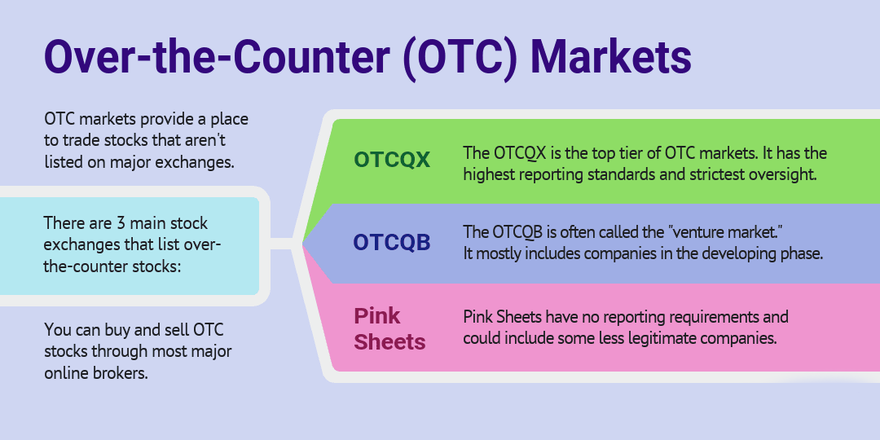

OTC Markets Group

The OTC Markets Group is a key player in the Over the Counter landscape, providing a structured platform for trading a diverse range of securities.

Structure of OTC Markets Group

The OTC Markets Group operates several tiers of markets, each catering to different types of securities and levels of company transparency. These tiers include:

| Level | Description |

| OTCQX | The highest tier, featuring companies that meet strict financial standards. It provides a higher level of investor protection and visibility. |

| OTCQB | Designed for early-stage and growth-oriented companies. While it has less stringent requirements than OTCQX, it still demands a degree of transparency. |

| Pink Open Market | Includes a wide range of companies, some of which may not meet the reporting standards of OTCQX or OTCQB. This tier features the least amount of regulation and can be riskier for investors. |

How to Trade on the OTC Market

Trading on the OTC market involves several steps and requires specific tools and platforms. The right approach to each step can significantly increase the chances of success.

Process of Trading on OTC

- Choosing a Broker

Selecting a broker that specializes in OTC trading is critically important. You need to ensure that the broker is regulated, has a good reputation, and provides access to the desired securities. - Creating an Account

The process of opening an account usually involves filling out various forms and providing identification documents. The broker may also request information about your financial situation to comply with KYC (Know Your Customer) regulations. - Researching Securities

Before investing, it is essential to conduct thorough research on potential OTC investments. This may include analyzing financial statements, market trends, and news that could impact asset values. - Placing Orders

After completing the research, investors can use their broker’s platform to place orders. It is important to remember the different types of orders (market orders, limit orders, etc.) and to choose the one that best fits your strategy.

Necessary Tools and Platforms

Brokerage Platform: An online platform providing access to Over the Counter markets should be user-friendly and intuitive, offering tools for analysis and research.

Research Tools: Access to market data and analytics can significantly enhance the quality of your trading decisions. Many brokers offer built-in tools for technical and fundamental analysis.

Risk Management Tools: Strategies and tools for managing risks, such as stop-loss orders and sell orders, are crucial to successful trading. They help limit losses in the event of unfavorable market movements.

The OTC market plays a significant role in the financial ecosystem, offering unique opportunities for investors seeking diversification. Understanding its structure and the types of available securities will help investors make more informed decisions.

Recommendations for Investors and Traders

- Conduct Thorough Research

Always stay informed about the companies and instruments you are considering. A deep understanding of the market can help you avoid serious mistakes. - Utilize Proper Risk Management Tools

Protect your investments by using strategies that minimize risk exposure. Set your orders to minimize potential losses. - Consider Your Investment Goals

Aligning your OTC trading strategies with your broader investment objectives will help you achieve your goals and avoid unnecessary risks.

Considering all these aspects, Over the Counter markets can be a valuable addition to any investment strategy, providing access to unique assets and opportunities.

FAQ

What is the difference between the OTC market and traditional exchanges?

The main difference between the OTC market and traditional exchanges lies in the absence of central regulation and fixed trading rules. In traditional exchanges, all trades occur through centralized mechanisms, ensuring high liquidity and greater transparency in price formation. Conversely, the OTC market may have less predictable and more flexible pricing mechanisms, which can be both an advantage and a disadvantage. It is also worth noting that the OTC market can have lower liquidity due to smaller trading volumes, sometimes leading to higher spreads (the difference between the buying and selling price).

What financial instruments are available in the OTC market?

The OTC market offers a diverse range of financial instruments, making it a unique platform for investors. Key instruments include:

- Stocks: Often, companies that do not meet listing requirements for major exchanges use the OTC market to raise capital.

- Bonds: Both corporate and government bonds can be found in the OTC market, allowing investors to seek more favorable terms.

- Derivatives: OTC derivatives, such as options and swaps, provide opportunities for hedging risks and speculating on the prices of various assets.

- Currencies: The Forex market largely represents an OTC market, where currency pairs are traded directly between participants.

- Cryptocurrencies: With the growing popularity of digital currencies, the OTC market has become an important platform for trading them, offering more stable prices for large transactions.

What are the main advantages of OTC trading?

OTC trading offers several advantages that may attract investors:

- Flexibility in deal terms: Participants can negotiate and set their own deal conditions, allowing them to find the most beneficial agreements for both sides.

- Access to niche markets: The OTC market opens access to assets and investment opportunities that may not be available on traditional exchanges, such as stocks of startups or specialized financial instruments.

- No strict listing requirements: Companies that do not meet criteria for public trading can raise capital through the OTC market, creating additional investment opportunities.

- Direct transactions: Trades occur directly between participants, which can foster stronger business relationships and trust.

What are the disadvantages of the OTC market?

Despite its advantages, the OTC market also has several disadvantages:

Lower transparency: Due to the lack of centralized oversight, information on prices and trading volumes may be less accessible, making it harder to assess the true value of assets.

Increased counterparty risk: The absence of a central clearinghouse means there is a risk that one party may default on their obligations, potentially leading to significant losses for investors.

Lower liquidity: Many assets in the OTC market may have low trading volumes, making it more difficult to sell them at desired prices.

Challenges in valuation: Due to the diversity of instruments and lack of standards, assessing risks and opportunities can be more complex than on traditional exchanges.