Momentum (MOM) in trading is one of the most powerful concepts in trading. It allows traders to capitalize on price movements that persist in one direction over a period of time. In this article, we’ll explore the meaning of momentum in trading, how it works, strategies that incorporate it, and the risks involved. Whether you’re a beginner or an experienced trader, this guide will provide valuable insights into momentum trading and how it can be used to improve your market performance.

What is MOM (Momentum) in Trading?

Momentum in trading refers to the tendency of an asset’s price to persist in the same direction — either upward or downward — over a specific period of time. Simply put, momentum measures the «strength» of a trend. It reflects how much an asset’s price is accelerating, driven by factors such as market psychology and investor sentiment.

How Momentum Works in Trading

Momentum (MOM) meaning in business is a result of a combination of factors, including market psychology and investor behavior. When an asset is trending upward, buying pressure from investors pushes the price higher. Conversely, when momentum is downward, selling pressure causes prices to fall. Momentum doesn’t always mean a continuous rise or fall, but rather the strength and consistency of price movement in one direction over time.

Key Indicators of Momentum:

- Relative Strength Index (RSI): This popular indicator measures overbought or oversold conditions. RSI values above 70 indicate overbought conditions (potentially a reversal point), while values below 30 suggest oversold conditions (a potential buying opportunity).

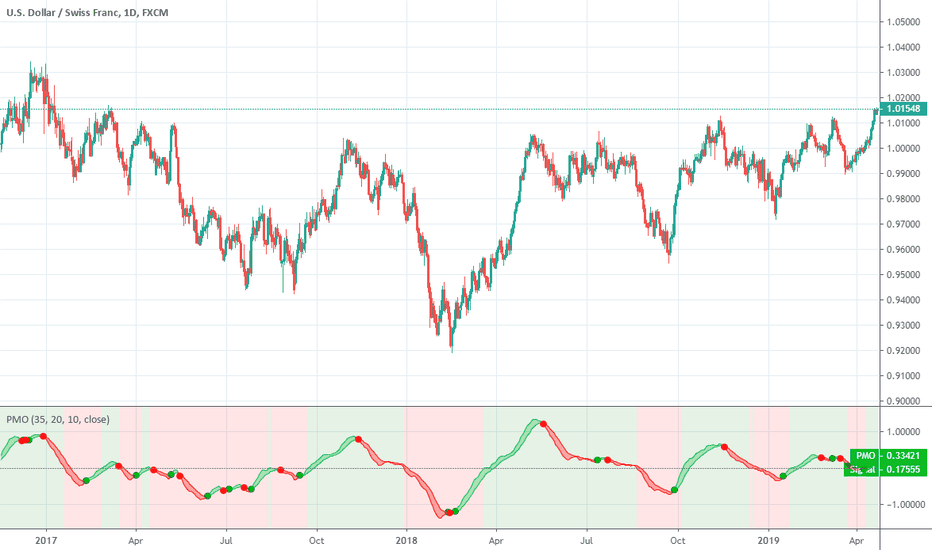

- Moving Average Convergence Divergence (MACD): This momentum indicator shows the relationship between two moving averages. A MACD crossover, where the short-term moving average crosses above the long-term moving average, signals bullish momentum. Conversely, a crossover below signals bearish momentum.

- Momentum Oscillator: This indicator measures the speed and strength of a price move, helping traders spot momentum shifts.

Practical Examples of Momentum Indicators in Action

Let’s look at some practical examples to see how momentum indicators can be applied in real trading situations.

Example 1: RSI in Action

Imagine you’re tracking a stock that has been in a strong uptrend for several weeks. As the price continues to rise, the RSI climbs towards 70. At this point, the asset is in an overbought condition. A trader using momentum trading would interpret this as a potential signal that the momentum is weakening, and the price may reverse soon. They may decide to exit the position or take profits.

Example 2: MACD in Action

Consider a stock that has been fluctuating for several weeks. You notice that the MACD is about to cross above its signal line. This crossover suggests that bullish momentum is building, and the trader may choose to enter a long position. A momentum trader would ride this upward trend until the MACD starts to reverse or shows signs of weakness.

Example 3: Breakout Trading

Let’s say a stock has been trading in a range, bouncing between $50 and $55. Suddenly, the price breaks above $55 with high volume, signaling that momentum has shifted upward. A momentum trader would enter a buy position, expecting the price to continue rising, and could set a stop-loss just below $55 to protect their investment. This breakout strategy capitalizes on significant price movements after a period of consolidation.

Risks in Momentum Trading

While momentum trading can be profitable, it’s not without risks. Let’s dive deeper into the potential pitfalls that traders face and how to mitigate them.

1. Risk of Reversal

Momentum can reverse unexpectedly, causing traders to lose money if they fail to act quickly. A sudden change in market conditions, such as an economic report or geopolitical event, can quickly shift the momentum in the opposite direction.

Example: A stock that has been rising steadily might experience a sharp decline after a negative earnings report. Traders relying solely on momentum indicators might be caught off guard by the reversal.

Mitigation Strategy: Traders should always use stop-loss orders to limit potential losses if the momentum shifts unexpectedly. A stop-loss is an order placed to sell a security when it reaches a certain price, minimizing losses if the market moves against them.

2. Overtrading

Momentum trading can tempt traders to act impulsively, especially during volatile periods. Overtrading can lead to significant losses, especially if the trader does not have a clear exit strategy.

Example: A trader might make multiple trades during a day based on short-term momentum indicators, but without a solid plan, they might miss critical reversals or fail to take profits in time.

Mitigation Strategy: Maintain a disciplined approach to risk management. Define a maximum percentage of your portfolio to risk per trade and adhere to predetermined entry and exit points.

3. False Signals

Momentum indicators can sometimes give false signals, especially in choppy or sideways markets. In these markets, the price might appear to trend in one direction, only to reverse shortly afterward.

Example: The RSI might indicate that an asset is overbought, but the price continues to rise, leading traders to make premature decisions based on faulty signals.

Mitigation Strategy: Combine momentum indicators with other technical analysis tools, such as trend-following indicators (e.g., moving averages), to confirm the signals and avoid entering false trades.

Momentum Trading vs. Other Strategies

Momentum trading is just one of several trading strategies. Let’s compare it with other popular approaches.

Momentum vs. Value Investing

Value investing focuses on finding undervalued assets that are trading below their intrinsic value. This strategy is often used by long-term investors who believe the market will eventually recognize the asset’s true value. In contrast, momentum trading looks to capitalize on short-term price movements driven by trends.

When Momentum Works Best: Momentum (MOM) meaning in business is most effective in a trending market. For example, when a stock is consistently rising due to strong earnings or positive news, momentum traders look to buy and ride the trend.

When Value Investing Works Best: Value investing is more suitable for long-term investors who prefer stability and are less concerned with short-term price fluctuations. In markets with high volatility or when prices are trading within a range, value investing may be more effective.

Practical Tips for New Traders

Here are some tips to help you get started with momentum trading:

- Choosing Assets for Momentum Trading: Focus on assets with high volatility and strong price movements. Stocks with consistent momentum (either up or down) are ideal for momentum trading.

- Discipline and Emotional Control: One of the keys to success in momentum trading is maintaining discipline. Don’t let emotions like fear or greed guide your decisions. Set your profit-taking and stop-loss levels in advance, and stick to them.

- Risk Management: Always use stop-loss orders to limit your downside risk. Never risk more than a small percentage of your total capital on any single trade.

- Position Sizing: Adjust your position size based on your trading capital and the volatility of the asset you’re trading. For example, in highly volatile markets, you may want to reduce your position size to account for larger price fluctuation

When evaluating momentum, it’s crucial to consider month-to-month comparisons and sequential growth in asset prices. By examining monthly performance shifts or month-over-month fluctuations, you can spot emerging trends and align your momentum strategies with the recent monthly trend.

For example, tracking the monthly growth rate of a stock can help identify whether the momentum is accelerating or slowing down. Month-on-month analysis is particularly useful in analyzing the longer-term sustainability of momentum in a particular asset or market.

Conclusion

Momentum (MOM) meaning in business is a powerful strategy that allows traders to capitalize on sustained price movements. By using key indicators like RSI, MACD, and momentum oscillators, traders can better understand month-over-month variation and recent monthly trends. However, like any trading strategy, momentum comes with its risks, including reversals, overtrading, and false signals.

To succeed with momentum trading, it’s essential to combine risk management techniques such as stop-loss orders and profit-taking strategies. By maintaining discipline and understanding the psychology behind momentum, traders can make more informed decisions and improve their trading success.

For experienced traders, momentum can be integrated into more complex strategies like swing trading or options trading to enhance profitability. With the right tools and techniques, momentum trading can be an effective way to ride trends and achieve consistent profits.

Final Tip: Momentum trading is best suited for active traders who can monitor the markets regularly and make quick decisions. If you’re new to trading, start with smaller trades and focus on building your skills in identifying and acting on momentum.

FAQ

How do momentum indicators work?

Momentum indicators like the RSI, MACD, and momentum oscillators help traders identify trends, measure the strength of price movements, and spot potential reversals. They provide insights into whether an asset is overbought or oversold, or if a price trend is gaining or losing strength.

What are the risks of momentum trading?

Some of the main risks include the possibility of a sudden reversal in market trends, overtrading, and false signals from indicators. It’s essential to use stop-loss orders and other risk management techniques to mitigate these risks.

How can I avoid false signals in momentum trading?

To avoid false signals, combine momentum indicators with other technical analysis tools, such as trend-following indicators (e.g., moving averages). This can help confirm whether a price move is likely to continue or reverse.

Is momentum trading suitable for long-term investors?

Momentum trading is generally better suited for short-term traders who seek to capitalize on trends. Long-term investors might prefer strategies like value investing, which focuses on finding undervalued assets for long-term gains.