In the world of technical analysis, candlestick patterns are essential tools for traders, offering insights into market psychology and predicting potential price movements. One such pattern that traders often encounter, especially after a strong bullish trend, is the Gravestone Doji candlestick. This pattern is widely regarded as a reversal signal, particularly in markets that have experienced prolonged upward momentum. In this comprehensive guide, we will examine the Gravestone Doji in detail, breaking down its structure, psychological underpinnings, technical significance, and how traders can effectively use this candlestick pattern to make more informed trading decisions.

Introduction to the Gravestone Doji Pattern

Definition of the Gravestone Doji Candlestick

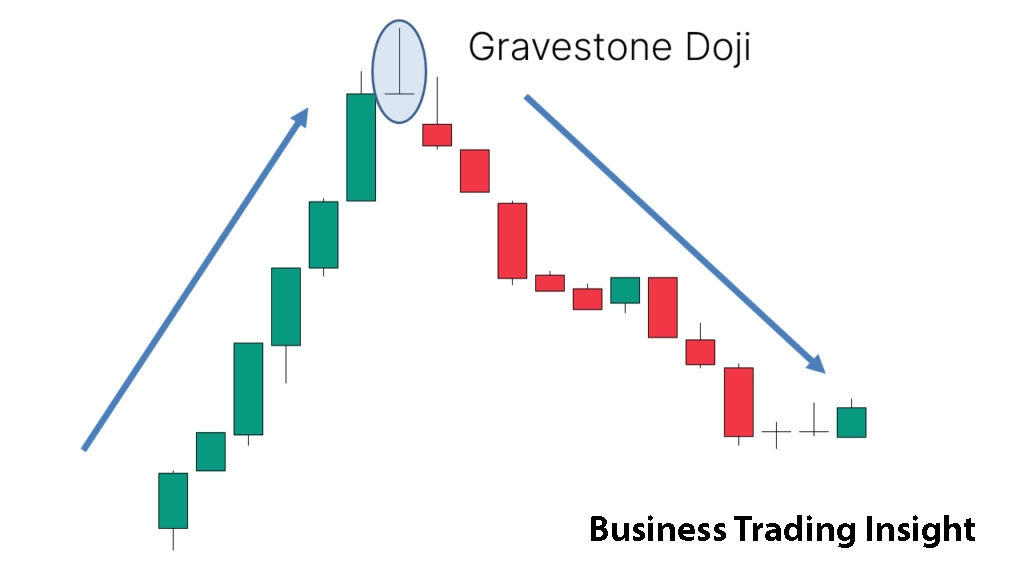

The Gravestone Doji is a specific type of candlestick that is easily identifiable by its distinctive structure: a small body located at the bottom of the candlestick, a long upper shadow, and little to no lower shadow. This configuration suggests that during the trading session, buyers initially took the market higher, only to be overpowered by sellers who drove the price back down to the opening level by the close.

The Gravestone Doji Candlestick occurs when the open and close prices are nearly identical, forming a small body at the bottom of the candlestick. The upper shadow extends far above the body, indicating that buyers attempted to push prices up during the session, but ultimately, the sellers regained control. The absence of a significant lower shadow indicates that the price did not fall during the session’s duration, suggesting that sellers were strong enough to push prices back down but not to push them lower than the opening price.

This candlestick is considered a bearish reversal signal, meaning it suggests that the price trend may soon shift from an uptrend to a downtrend. The Gravestone Doji is especially powerful when it appears after an extended bullish trend, signaling a potential change in market sentiment.

Name and Symbolism of the Gravestone Doji

The term «Gravestone Doji Candlestick» comes from the visual resemblance to a gravestone. The small body located at the bottom of the candlestick and the long upper shadow that extends above it resemble the upright stone of a grave, with the body representing the base of the stone. This imagery evokes the notion of the end of a bullish move, with the candlestick symbolizing the «death» or termination of the uptrend.

The Gravestone Doji Candlestick is a potent symbol in technical analysis because it visually represents the struggle between buyers and sellers. Despite the initial upward price movement, the failure of the bulls to maintain control, combined with the sellers’ ability to push the price back down, signifies a shift in market dynamics that could result in a downtrend.

Traders who recognize the Gravestone Doji pattern on a chart may view it as an early warning sign that the upward momentum is dissipating and that a shift in sentiment could lead to lower prices in the near future.

Structure and Characteristics of the Candlestick

Formation of the Gravestone Doji

To understand the Gravestone Doji Candlestick, it’s essential to break down its individual components. The pattern is formed when the open and close prices are close to each other at the bottom of the candlestick, and the upper shadow is much longer than the body. Here’s a detailed analysis of each element:

- The Body: The body of the candlestick is small and located at the bottom of the candle. It represents the difference between the open and close prices. Because the opening and closing prices are nearly identical, the body of the candlestick will appear short and often appear at the bottom of the candlestick. This small body signifies indecision in the market, as neither the buyers nor the sellers can push the price very far from the opening and closing points.

- The Upper Shadow: The defining feature of the Gravestone Doji Candlestick is its long upper shadow. This shadow signifies that buyers attempted to push prices higher during the trading session. However, sellers regained control and pulled the market back down to the opening price. The long upper shadow suggests a failure of the bullish momentum, which could indicate that the uptrend is losing steam. The long upper shadow also emphasizes the strength of the selling pressure in the market.

- The Lower Shadow: One of the key characteristics of the Gravestone Doji is the absence of a lower shadow or a very minimal one. The lack of a lower shadow indicates that sellers were not strong enough to push the price below the opening level. While buyers initially gained control during the session, the inability of sellers to drive prices lower further reinforces the idea that the session ended with the sellers in control.

The combination of the small body, the long upper shadow, and the lack of a lower shadow creates a distinctive candlestick shape that traders can easily spot on price charts.

Visual Features

Visually, the Gravestone Doji Candlestick looks like a cross or a gravestone. The body sits at the bottom of the candlestick, while the long upper shadow extends upward, much like the headstone of a grave. This unique appearance makes it easy for traders to identify on candlestick charts, and its distinct shape signals a shift in market sentiment.

The Gravestone Doji Candlestick is particularly important in markets that have been in a strong bullish trend for an extended period. Its formation suggests that, despite initial buying pressure, the sellers have now gained control, potentially signaling the end of the uptrend and the beginning of a downtrend.

Psychology and Market Participants’ Behavior

Behavior of Buyers and Sellers

The Gravestone Doji Candlestick pattern reflects the ongoing struggle between buyers (bulls) and sellers (bears) during a given trading session. Here’s how the psychology of each group plays out:

- The Buyers: At the beginning of the trading session, buyers are in control. They push the price higher, attempting to extend the uptrend. The market moves upward, and for a while, it seems like the bulls have the upper hand.

- The Sellers: However, as the session progresses, sellers begin to gain momentum. Despite the initial buying pressure, sellers begin to push the market back down toward the opening price. By the close of the session, the price has returned to the opening level, and the Gravestone Doji Candlestick forms, with the long upper shadow representing the failed attempts of buyers to maintain the price at higher levels.

The Gravestone Doji indicates that the bullish momentum has been exhausted, and the buyers no longer have the power to continue pushing prices higher. On the other hand, the sellers’ ability to push the price down to the opening level suggests that the sellers are beginning to take control.

Signal for Reversal

The Gravestone Doji Candlestick is widely viewed as a bearish reversal signal. When this candlestick appears after a strong uptrend, it suggests that the market may be nearing a turning point. The long upper shadow signals that buyers tried to push prices higher but failed, while the small body at the bottom indicates that there was no further upward momentum. The absence of a lower shadow indicates that sellers were able to maintain control by driving the price back down.

As such, the Gravestone Doji Candlestick indicates that the bullish trend is losing strength and may soon reverse into a downtrend. Traders often look for this pattern as a sign that the market is ready for a correction or trend reversal, particularly after a prolonged period of upward price movement.

Technical Significance and Interpretation

Trend Reversal Signal

The Gravestone Doji is particularly effective as a trend reversal signal when it appears after a strong uptrend. Traders typically look for this pattern in trending markets, as it provides an early indication that the bullish trend is weakening and may soon reverse. The pattern suggests that the market has become overbought and that sellers are beginning to take control.

When a Gravestone Doji Candlestick appears in an overbought market, it can indicate that the upward price movement has reached its peak, and the market is likely to experience a downtrend. As the buyers lose momentum, the sellers gain control, and the price begins to fall.

The Gravestone Doji pattern serves as a warning sign for traders that the current trend may not be sustainable and that a trend reversal could be imminent.

Trending Markets

The Gravestone Doji is most significant after a prolonged bullish trend when the market is in an overbought condition. In these situations, the Gravestone Doji Candlestick signals that the buyers have exhausted their strength, and the sellers are beginning to regain control. This is the moment when the market is most likely to change direction and begin a downward reversal.

Contrast with the Dragonfly Doji

To better understand the significance of the Gravestone Doji, it’s helpful to compare it with the Dragonfly Doji, which is its opposite. Both candlestick patterns have the same general structure, with a small body and long shadows. However, the Dragonfly Doji has a long lower shadow instead of an upper shadow, and it signifies that buyers were in control throughout most of the trading session.

In a Dragonfly Doji, the price opens and closes at the same level, with the long lower shadow showing that buyers overcame the sellers’ initial push to lower the price. The Dragonfly Doji indicates a bullish reversal, suggesting that after a period of downward price action, buyers are gaining control.

On the other hand, the Gravestone Doji Candlestick has a long upper shadow and suggests that sellers have gained control during the session, even though buyers initially attempted to push prices higher. The Gravestone Doji indicates a bearish reversal, signaling the end of a bullish trend and the possible start of a downtrend.

Conditions for Formation and Context of Use

Appearing After a Bullish Trend

For the Gravestone Doji Candlestick to be considered a strong reversal signal, it should appear after an extended period of upward price movement. When the market is in a strong bullish trend, the Gravestone Doji serves as an alert that the buyers are running out of steam and that a reversal to the downside may be coming.

This pattern is especially significant when it forms at resistance levels or when the market shows signs of being overbought. Traders should watch for the Gravestone Doji to form at key price levels where selling pressure may begin to increase, such as near historical resistance zones, Fibonacci retracement levels, or overbought conditions indicated by other technical indicators.

Confirmation of Reversal

A Gravestone Doji Candlestick by itself is not always a reliable reversal signal. For a higher probability of success, traders often wait for confirmation from subsequent price action. The confirmation could come in the form of a bearish candlestick that follows the Gravestone Doji. If the following candle is bearish, it suggests that sellers have indeed taken control and that the trend is likely to reverse.

Another form of confirmation could come from an increase in trading volume, which indicates that the sellers are actively driving the price lower. Traders may also use other technical indicators, such as RSI or Stochastic Oscillators, to confirm that the market is overbought and due for a correction.

Using in Conjunction with Other Indicators

The Gravestone Doji is most effective when used in conjunction with other technical analysis tools. Some of the indicators that can help confirm the reversal signal include:

- Volume indicators: A significant increase in volume when the Gravestone Doji Candlestick appears can provide strong confirmation that the market is indeed reversing.

- Support and resistance levels: If the Gravestone Doji Candlestick forms at a significant resistance level, it is more likely to indicate that the uptrend is reversing and a downtrend is about to begin.

- Oscillators (e.g., RSI or Stochastic): If the RSI or Stochastic Oscillator shows overbought conditions, the Gravestone Doji becomes a more reliable indicator of a potential trend reversal.

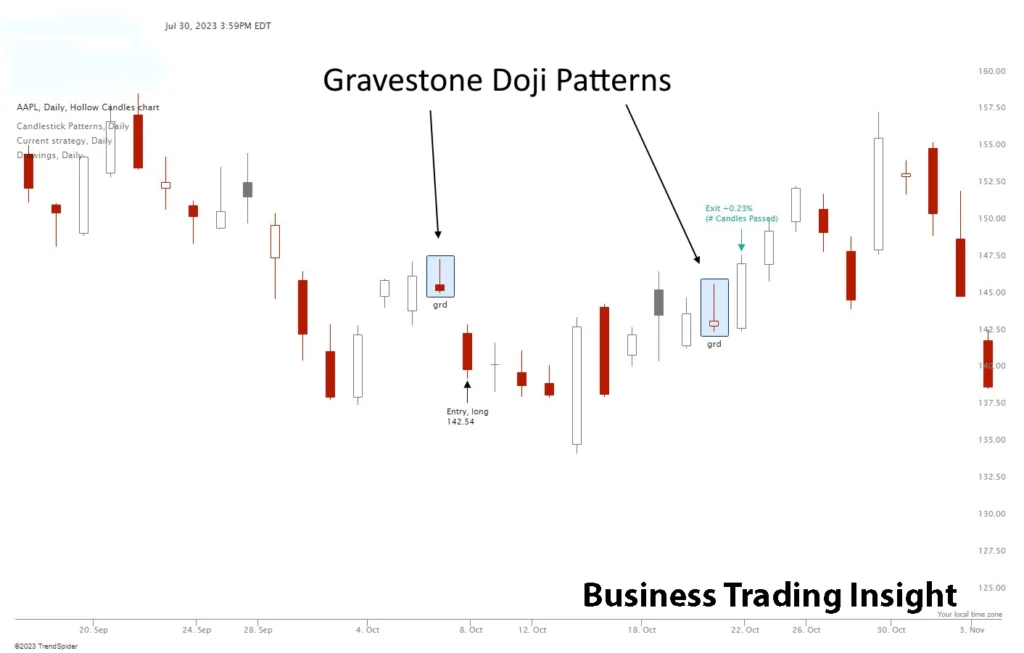

Examples on a Chart

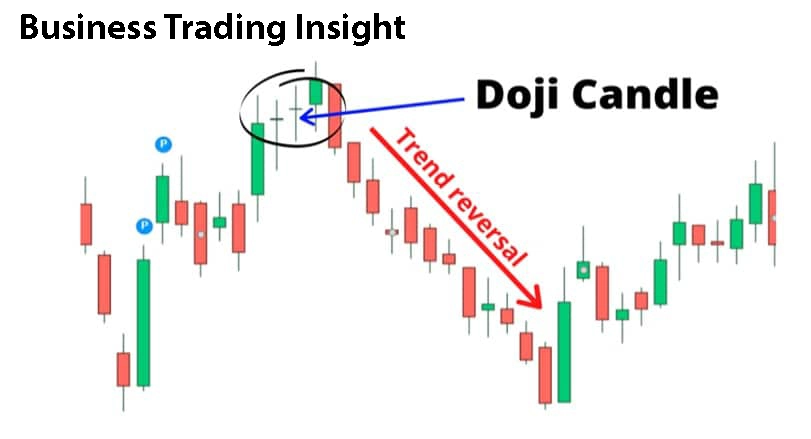

Example of a Bullish Trend Followed by a Gravestone Doji

A common scenario where the Gravestone Doji Candlestick appears is after a long bullish trend. In this case, the Gravestone Doji forms at the peak of the uptrend, and the following candlestick is bearish, confirming the trend reversal. Traders would interpret this as a signal that the market is shifting from a bullish trend to a downtrend.

Example of a False Signal

In some cases, the Gravestone Doji may produce a false signal. For example, in highly volatile markets or in periods of uncertainty, a Gravestone Doji Candlestick may form, but the market may not reverse and instead continue moving in the same direction. Traders should always look for additional confirmation, such as volume spikes or bearish candlesticks, before acting on a Gravestone Doji signal.

Limitations and Risks of Using the Gravestone Doji

False Signals

One of the biggest risks when using the Gravestone Doji is the possibility of false signals. In highly volatile markets or in conditions of low liquidity, the Gravestone Doji Candlestick might appear, but the expected reversal does not occur. The price may continue moving in the same direction, causing traders who act on the signal to incur losses.

Context Dependency

The Gravestone Doji Candlestick is not always a reliable signal on its own. Traders should always evaluate the pattern in the context of other market factors. If the Gravestone Doji forms in a range-bound market or during a consolidation phase, it may not be as strong of a reversal signal. The pattern should always be combined with other indicators or technical tools for a more accurate analysis.

Market Volatility

Highly volatile markets, such as cryptocurrencies or commodities, may present greater risks when trading with the Gravestone Doji. Extreme price fluctuations can cause the pattern to appear and disappear quickly, leading to potential false signals. In such markets, traders should exercise caution and look for confirmation before acting on the pattern.

Advantages and Disadvantages of the Gravestone Doji

| Advantages | Disadvantages |

| Accuracy of Signal: When used correctly, the Gravestone Doji can be a strong indicator of a trend reversal, especially when it forms after a long uptrend. | False Signals: In volatile markets or low-liquidity conditions, the Gravestone Doji may provide inaccurate predictions of a trend reversal. |

| Ease of Identification: The Gravestone Doji is relatively simple to spot on a price chart due to its distinct structure, making it accessible to traders of all experience levels. | Dependence on Confirmation: To increase the accuracy of the signal, the Gravestone Doji should be used in conjunction with other analysis tools and should not be relied upon in isolation. |

Conclusion

The Gravestone Doji Candlestick is a powerful candlestick pattern that can provide traders with valuable insights into potential trend reversals. Its formation indicates a shift in market sentiment, where the buyers’ initial control is overtaken by sellers, signaling the possible end of an uptrend and the start of a downtrend. However, like all candlestick patterns, the Gravestone Doji is most effective when used in combination with other technical analysis tools and confirmation indicators.

By understanding its structure, market psychology, and proper context for use, traders can use the Gravestone Doji to make more informed trading decisions and potentially increase their profitability in trending markets. Always remember that confirmation is key, and the Gravestone Doji Candlestick should never be relied upon as a standalone indicator.

FAQ

How do traders interpret the Gravestone Doji?

Traders interpret the Gravestone Doji as a bearish reversal signal, especially after a prolonged uptrend. It indicates that the buyers' control is weakening, and the sellers are starting to take over. Traders look for this pattern to signal the potential end of an uptrend and the beginning of a downtrend. However, it is often used in conjunction with other indicators or confirmation signals to increase its reliability.

When is the Gravestone Doji most significant?

The Gravestone Doji is most significant when it appears after a strong, prolonged bullish trend. This is because, in such a context, it suggests that the buyers' momentum has run out, and the sellers are starting to take control. The pattern is particularly notable when it forms at resistance levels, overbought conditions, or when the market shows signs of exhaustion.

How can I confirm a Gravestone Doji signal?

A Gravestone Doji by itself may not be enough to confirm a reversal. Traders typically wait for additional confirmation, such as:

- A bearish candlestick following the Gravestone Doji, indicating that the sellers have indeed taken control.

- Increased trading volume, suggesting that sellers are actively driving the price lower.

- Other technical indicators, such as the RSI or Stochastic Oscillators, showing overbought conditions, which further reinforce the potential for a reversal.

Can the Gravestone Doji give false signals?

Yes, the Gravestone Doji can give false signals, especially in volatile markets or low liquidity conditions. In some cases, the pattern may appear, but the expected reversal does not happen, and the price continues in the same direction. It is important to use the Gravestone Doji in conjunction with other indicators and tools to reduce the likelihood of false signals.