In the dynamic and high-stakes world of financial markets, having a fast, reliable, and standardized communication protocol is essential. FIX API (Financial Information Exchange Application Programming Interface) serves as the backbone for modern electronic trading, enabling seamless communication between financial institutions, brokers, exchanges, and traders. This article provides a comprehensive guide on FIX API, explaining what it is, how it works, its benefits, and how to implement it effectively for your trading operations.

Definition of FIX API: What FIX API is and What it Stands For

FIX API stands for Financial Information Exchange Application Programming Interface, a standardized interface designed for real-time electronic communication in the financial markets. It is used to exchange trade-related information, including market data, order placement, execution reports, and more. Built upon the FIX Protocol, this API provides a standardized way for systems to communicate across different platforms and market participants globally.

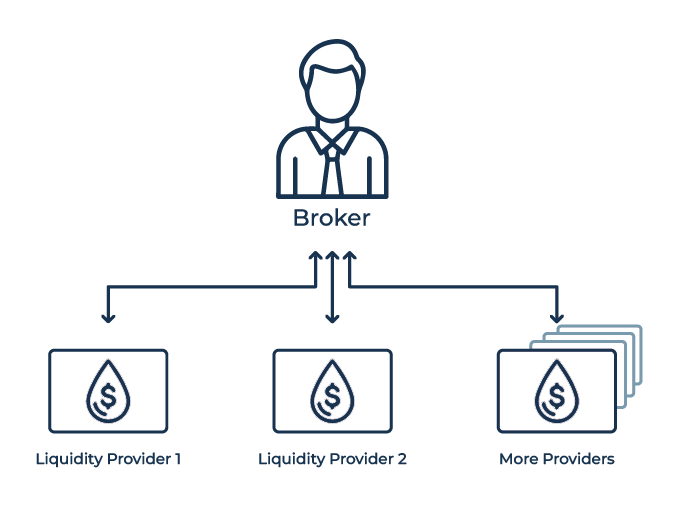

The primary role of FIX API is to ensure fast, efficient, and secure data exchange between traders, brokers, exchanges, and liquidity providers. By using FIX API, financial institutions and traders can automate their trading processes, minimize latency, and reduce human errors.

Why is FIX API Crucial for Modern Trading?

The use of FIX API has become indispensable in the world of algorithmic and high-frequency trading (HFT). The protocol enables near-instantaneous transmission of market data and orders, which is vital for trading strategies that depend on speed and precision. With FIX API, financial systems can instantly interact with liquidity providers and exchanges, making it possible for traders to capitalize on microsecond market fluctuations that are typical in today’s fast-paced trading environment.

Why is FIX API Needed?

Key Benefits of Using FIX API in Financial Trading

- Speed and Efficiency: One of the most critical benefits of FIX API is its low-latency transmission of trade messages. High-frequency trading and algorithmic trading strategies rely on FIX API to execute large volumes of trades with minimal delay, which is essential in gaining a competitive edge.

- Real-Time Data Access: FIX API allows users to access live market data—such as quotes, orders, and execution reports—immediately. This is invaluable for traders who need up-to-the-minute data to make decisions.

- Standardized Communication: FIX API helps reduce integration issues between different trading platforms by providing a uniform message format. As it is an open standard, FIX API enables compatibility between various systems used by brokers, exchanges, and other market participants.

- Security and Reliability: FIX API protocols ensure secure data exchange through encryption and authentication techniques, protecting sensitive financial data from unauthorized access and ensuring reliable transmission.

- Scalability: Whether you’re a retail trader or an institutional investor, FIX API can scale to accommodate high trade volumes. It supports real-time transmission of thousands of messages per second, making it ideal for large-scale trading operations.

- Cost Efficiency: By automating communication between trading platforms, FIX API reduces the need for manual intervention, thus minimizing operational costs and the risk of errors.

Purpose of This Article

This article aims to provide an in-depth understanding of FIX API, its importance in financial markets, how it works, and how to implement it for trading operations. Whether you are a trader, financial institution, or developer, understanding FIX API is key to taking advantage of its powerful features and capabilities.

History and Evolution of FIX Protocol

What is FIX?

The FIX Protocol is an open-standard messaging protocol designed to facilitate the exchange of real-time financial information between market participants. Initially focused on equity trading, the FIX Protocol has expanded over time to include asset classes like fixed income, derivatives, foreign exchange (FX), and cryptocurrencies.

The FIX Protocol is designed to be extensible, supporting a wide range of message types (such as order requests, execution reports, and trade cancellations) to meet the needs of modern financial markets. It is the backbone for FIX API, ensuring that financial data is communicated quickly, accurately, and reliably.

The History of FIX Protocol

The FIX Protocol was developed in 1992 by a consortium of financial firms who recognized the need for a standardized messaging system that could streamline communication between exchanges, brokers, and traders. Prior to FIX, each organization used proprietary communication systems, which created barriers to interoperability.

Since then, FIX API has become the global standard in financial messaging, with updates and revisions that continually improve the protocol’s functionality. It has become a critical component of electronic trading systems across various asset classes worldwide.

Evolution of FIX API

Over time, as trading systems became more automated and technology advanced, the FIX Protocol evolved into FIX API, offering more flexibility, better performance, and support for newer technologies like algorithmic trading and high-frequency trading (HFT). Today, FIX API supports both buy-side and sell-side participants, offering deep integration with trading platforms, liquidity providers, and exchanges.

How FIX API Works

How Does FIX API Work?

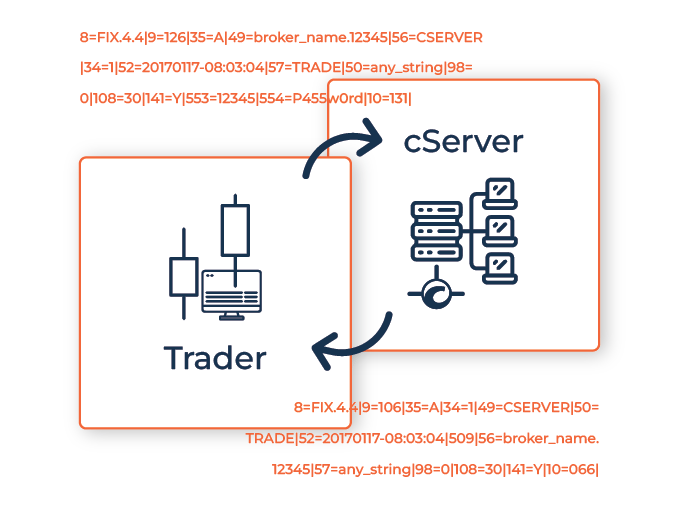

At its core, FIX API facilitates the exchange of structured messages between systems. These messages are composed of standardized tags, data fields, and message types that define the content and purpose of the communication. Here’s an overview of how FIX API works:

- Message Creation: Traders or algorithms create a message that could be a new order, a market data request, or an execution report. The system then structures the message in the format specified by the FIX Protocol.

- Message Formatting: Each message contains various tags that represent specific data points (e.g., price, quantity, order type). The message follows the FIX standard to ensure compatibility with other systems.

- Transmission: The message is transmitted through a secure connection to the recipient (e.g., broker, exchange, or liquidity provider) over a FIX session.

- Message Processing: Upon receiving the message, the recipient processes it according to its type. For example, an order message might result in a trade execution, while a market data request could return real-time prices.

FIX Message Format

A typical FIX message consists of:

- Tags: Unique identifiers for different data fields (e.g., 35=D for New Order, 55=EURUSD for currency pair).

- Data: The actual values being transmitted (e.g., price, quantity, order type).

- Message Types: The message type determines the purpose of the communication, such as order placement, trade execution, or market data request.

What is a FIX Session?

A FIX session refers to the ongoing connection between two systems (e.g., a trader and an exchange). The session maintains synchronization, manages message sequencing, and ensures error-free transmission of messages. During a session, various controls such as heartbeat intervals and message sequence numbers are employed to maintain the session’s integrity and ensure that no messages are lost.

Advantages of Using FIX API

High Speed and Low Latency

One of the biggest advantages of FIX API is its ultra-low latency. For high-frequency traders and those using algorithmic trading, every millisecond counts. FIX API ensures that messages are transmitted with minimal delay, which is vital for executing trades based on market movements that occur in real-time.

Scalability and Performance

FIX API is built to handle large volumes of messages per second. Whether you’re sending a few orders a day or handling thousands of trades, the protocol’s scalability ensures that it can handle the growing demands of modern trading.

Interoperability and Flexibility

As an open, standardized protocol, FIX API ensures seamless communication between various trading systems, including brokers, exchanges, and liquidity providers. This interoperability reduces the cost and complexity of integration, making it easier for market participants to connect and communicate.

Security and Reliability

FIX API incorporates multiple security layers to ensure that sensitive financial data is transmitted safely. Secure connections (via TLS/SSL) protect the integrity of the messages, and authentication mechanisms ensure that only authorized systems can send and receive data.

Cost Efficiency

By automating the exchange of trade-related information, FIX API reduces the need for manual intervention, improving operational efficiency and reducing costs. This is especially beneficial for institutional traders and large-scale operations.

Applications of FIX API

Trading on Financial Markets

FIX API is used across various financial markets to facilitate order placement, market data retrieval, and execution reports. It enables real-time interaction with exchanges and liquidity providers, allowing traders to place orders and receive market data efficiently.

Algorithmic and High-Frequency Trading

For algorithmic trading and high-frequency trading strategies, FIX API is an essential tool. These strategies require fast execution, and FIX API’s low-latency design ensures that orders are placed and executed swiftly, with minimal delays.

Connecting to Brokers and Exchanges

Brokers and exchanges use FIX API to offer clients seamless access to their trading platforms. By integrating FIX API, brokers enable direct connections to liquidity pools, which improves pricing and execution speed.

How to Set Up FIX API

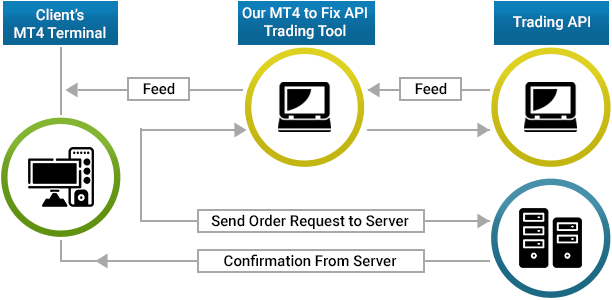

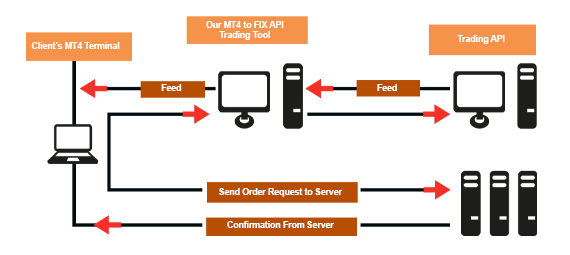

Setting up FIX API involves configuring the infrastructure, software, and communication protocols. Here’s an overview of the setup process:

Technical Requirements

To implement FIX API, you’ll need:

- A FIX engine that manages message sequencing and session management.

- Secure internet connections and servers capable of handling high-throughput messaging.

- Authentication credentials, including public/private keys or user IDs, depending on the security protocol.

Configuring Connections and Authorization

You will need to configure connection parameters (IP addresses, port numbers) and authentication details to connect securely with the system (broker, exchange). This involves setting up login credentials and configuring TLS/SSL encryption for secure communication.

Message Handling and Error Management

Handling error messages and maintaining message sequence integrity are essential for the successful operation of FIX API. It’s important to implement mechanisms to handle common errors like missing or out-of-sequence messages and connection failures.

Security and Risk Management in FIX API

Security Protocols for FIX API

To ensure the secure transmission of sensitive financial data, FIX API leverages TLS/SSL encryption and authentication methods, such as public/private key pairs. These methods guarantee that only authorized parties can send and receive data, protecting users from potential cyber threats.

Additionally, it is important to implement message-level security and ensure that all messages are transmitted over secure channels to prevent data breaches.

Latency and Performance Considerations

FIX API is designed to minimize latency, but poor infrastructure, network congestion, or hardware limitations can introduce delays. It’s essential to continuously monitor the system’s performance and optimize the infrastructure to ensure the best possible trading experience.

The Future of FIX API

Blockchain and AI Integration

The future of FIX API looks promising, with blockchain and artificial intelligence (AI) expected to play an increasing role in its evolution. For instance, FIX API could be used in the context of tokenized assets, offering real-time trading and settlement of digital securities. Furthermore, AI-powered trading systems could leverage FIX API to execute trades based on complex algorithms.

Adoption of 5G Networks

With the rollout of 5G networks, latency will be further reduced, making FIX API even faster and more efficient for high-frequency traders.

Increasing Use in Crypto Markets

As cryptocurrency markets continue to grow, FIX API will likely be integrated with digital asset exchanges to facilitate secure and efficient trading of cryptocurrencies.

Conclusion

In today’s fast-paced trading world, FIX API is indispensable for anyone looking to engage in electronic trading. Its low-latency, secure, and standardized messaging system ensures smooth communication between traders, brokers, and exchanges, driving efficiency and profitability. By understanding FIX API and utilizing its full potential, traders and financial institutions can gain a significant competitive advantage in the market.

Future Prospects

The ongoing development of FIX API will continue to shape the future of trading, with advancements in AI, blockchain, and 5G networks all playing a role in enhancing its capabilities.

FAQ

How does FIX API improve trading speed in financial markets?

FIX API optimizes trading speed by minimizing message latency. It is designed to ensure fast, real-time communication, which is essential for high-frequency trading and algorithmic strategies.

How it works:

- Instant Trade Execution: FIX API enables the sending of trade orders and receiving of market data with minimal delay, ensuring faster decision-making.

- Low Latency: The FIX protocol minimizes the time required for establishing a connection and exchanging data, improving trading efficiency.

- High-Volume Data Handling: FIX API can process and transmit large volumes of trading data quickly, which is crucial in high-frequency trading (HFT) environments.

What types of financial instruments can be traded through FIX API?

Through FIX API, a wide range of financial instruments can be traded, including but not limited to:

- Stocks and Bonds: The protocol is used for trading securities on stock exchanges, providing traders with access to buy and sell orders for stocks.

- Futures and Options: FIX API also supports the trading of derivatives like futures contracts and options.

- Currency Pairs (FX): It is actively used in the foreign exchange (FX) markets to execute buy/sell orders for currencies.

- Cryptocurrencies: Some cryptocurrency exchanges have started integrating FIX API to improve trading operations and data exchange between traders and platforms.

- Commodities and Indices: It also supports trading in commodities (e.g., oil, gold) and financial indices via FIX API.

What is the FIX protocol, and how does it differ from other data exchange protocols?

FIX (Financial Information eXchange) is an open, global protocol for exchanging financial information between market participants. It was designed to provide an efficient, standardized, and secure way to communicate between brokers, traders, exchanges, and other financial institutions.

Differences from Other Protocols:

- Standardized Format: FIX is a standardized protocol, which makes it easier to integrate different trading systems and platforms.

- High Speed and Low Latency: FIX API specializes in low-latency data transmission, which is important for high-frequency trading and fast order execution.

- Consistency: Unlike protocols used in other industries (e.g., HTTP or FTP), FIX is tailored specifically for financial operations, ensuring higher reliability and compatibility.

- Wide Application: FIX is used across a broad range of financial transactions, from stocks to futures and currencies, unlike other protocols that may be limited to specific asset classes.

How do you set up FIX API to connect to a trading platform or broker?

Setting up FIX API for connection to a trading platform or broker involves several steps. It requires technical expertise and access to the broker’s or exchange's documentation.

Steps for Setup:

- Obtain FIX Credentials: First, you need to register with the broker or exchange to receive unique login credentials for FIX API access (such as username and password).

- Configure the FIX Engine: Set up the FIX engine to establish a connection with the trading platform. This includes configuring session parameters, such as port, protocol version, participant identifiers, etc.

- Security Setup: Implement security through TLS/SSL for encrypting data and authentication using certificates or keys.

- Connection Testing: Before live trading, perform connection tests by sending test orders to ensure that the configuration is correct.

- Monitoring and Maintenance: Continuously monitor the activity via FIX API to detect errors or issues and make real-time adjustments.