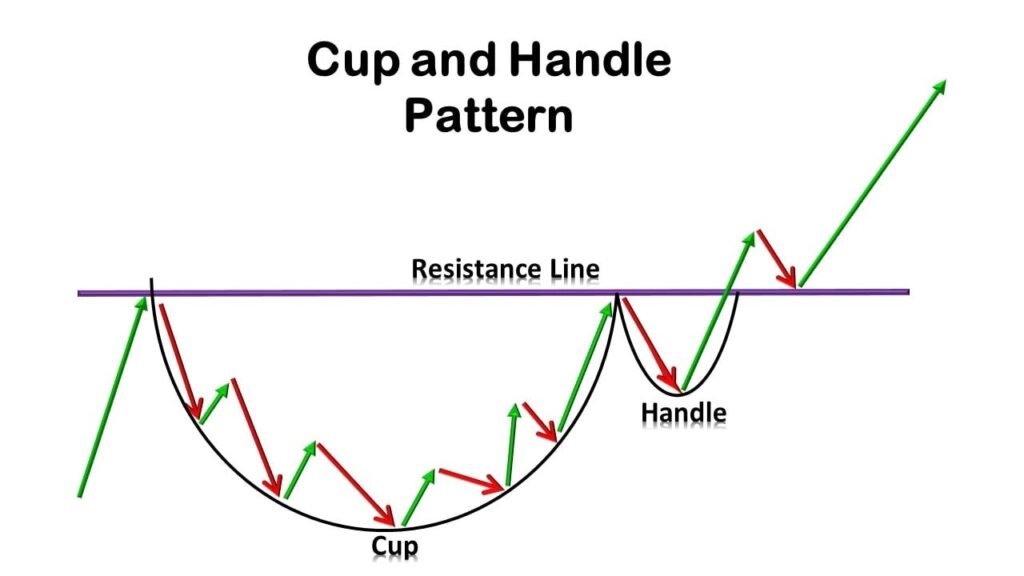

The cup and handle pattern is a technical analysis formation that indicates a potential bullish reversal or continuation in the stock market. This pattern resembles a cup with a handle, hence its name, and is widely used by traders to identify favorable buying opportunities.

Explanation of the Pattern and Its Components

The cup and handle pattern consists of two main components:

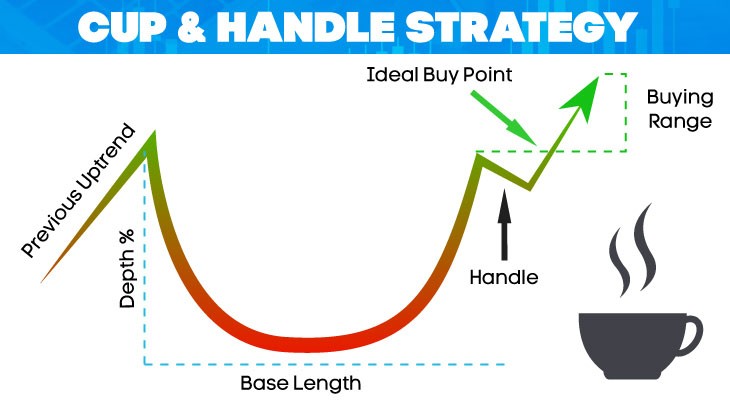

- The Cup: This part of the pattern typically resembles a «u» shape. It is formed when the price of an asset declines, creating a rounded bottom, followed by a gradual increase back to the previous high. This part represents a period of consolidation.

- The Handle: After the cup is formed, the price retraces slightly, forming the handle, which generally slopes downward. The handle signifies a brief pause before the price potentially breaks out to the upside.

What Does a Cup and Handle Pattern Tell You?

Market Psychology

The cup and handle pattern provides significant insights into investor sentiment. Initially, as the price declines to form the cup, fear may dominate the market, leading to selling pressure. However, as the price starts to recover, investor confidence begins to build, suggesting a potential shift from pessimism to optimism.

Trend Indication

This pattern signals a potential bullish movement in the market. Once the price breaks above the resistance level formed by the high of the cup, it often leads to an increase in buying pressure, indicating a favorable trend for traders.

How to Identify a Cup and Handle Pattern?

Characteristics of the Cup

The cup should ideally have a rounded bottom, indicating a smooth transition from decline to recovery. The depth of the cup is also crucial; it should not drop more than 30% from the peak. A deeper cup may indicate more selling pressure, while a shallow cup suggests a more stable price action.

Characteristics of the Handle

The handle should be formed after the cup and typically takes a shorter time to form than the cup itself. It often retraces about 1/3 to 1/2 of the advance that occurred from the bottom of the cup to the peak. The handle should be positioned slightly below the resistance level established at the top of the cup.

Volume Analysis

Volume plays a vital role in confirming the cup and handle pattern. Ideally, the volume should decrease during the formation of the cup and handle, followed by a surge in volume upon the breakout above the handle. This increased volume validates the bullish signal.

What Are the Types of Cup and Handle Patterns?

Cup and Odd Handle

The cup and odd handle variant features a handle that is not perfectly symmetrical. It may have unique features, such as irregularities in its formation, but it still retains the fundamental characteristics of the cup and handle pattern. Traders should be aware of these deviations when assessing potential trades.

Multi-Year Cup and Handle

This pattern emerges over a longer time frame, often spanning several years. While it indicates a long-term bullish sentiment, investors should consider market fundamentals and external conditions that may affect the asset’s performance over such extended periods.

Intraday Cup and Handle

Traders focusing on shorter time frames may encounter intraday cup and handle patterns. These formations usually occur within a single trading day and require rapid decision-making and execution. Understanding the nuances of these patterns is crucial for day traders.

How to Trade the Cup and Handle

Entry Points

When trading the cup and handle pattern, the optimal entry point is often just above the resistance level created at the peak of the cup. This breakout signifies the transition from a consolidation phase to a potential upward movement. Traders should look for confirmation through increased volume.

Stop-Loss Placement

To manage risk effectively, placing a stop-loss order just below the low of the handle is advisable. This strategic placement helps protect against false breakouts and unexpected price reversals.

Target Price

Determining a target price is critical for effective trading. A common method is to measure the distance from the bottom of the cup to the peak and project that distance upward from the breakout point. This target can serve as a guideline for setting profit-taking levels.

Example Trading the Cup and Handle

Real-World Example

Consider a stock that formed a cup over a six-month period. After the price retraced to form the handle, it broke out above the resistance level with strong volume. The entry point would be just above the breakout point, and a stop-loss would be placed below the handle.

Analysis of Results

In this scenario, if the stock moves up as anticipated, reaching the target price within a few weeks, the trade could result in substantial profits. Conversely, if the price fails to sustain the breakout, the stop-loss would trigger, limiting losses.

Limitations of the Cup and Handle Pattern

False Signals

While the cup and handle pattern can provide valuable trading signals, it is essential to be aware of false breakouts. Not every cup and handle formation leads to a bullish move. Therefore, traders should look for additional confirmation signals, such as price action or other technical indicators.

Market Conditions

External factors, such as overall market sentiment, economic news, or geopolitical events, can impact the reliability of the cup and handle pattern. Traders must consider these influences when assessing the strength of the signal.

What Does a Cup and Handle Pattern Indicate?

Bullish Sentiment

Ultimately, the cup and handle pattern indicates a strong potential for bullish sentiment in the market. When correctly identified and executed, this pattern can lead to profitable trading opportunities and serve as a valuable addition to a trader’s toolkit.

Key Takeaways

- The cup and handle pattern is a significant bullish indicator in technical analysis.

- Proper identification of the pattern involves understanding the characteristics of both the cup and the handle, as well as volume analysis.

- Different variations of the pattern exist, catering to various trading styles.

- Risk management strategies, including stop-loss placement and target pricing, are essential for successful trading.

- Awareness of market conditions and potential false signals is crucial for effective decision-making.

By mastering the cup and handle pattern, traders can enhance their strategies and increase their chances of success in the ever-evolving financial markets.