Cost of Carry is a term widely used in financial markets to describe the total expenses associated with holding or storing an asset over a period. These expenses may include financing costs, insurance, storage, and other miscellaneous costs that can arise while holding the asset. Understanding the concept of Cost of Carry is crucial for investors and traders, especially when dealing with derivatives and futures contracts.

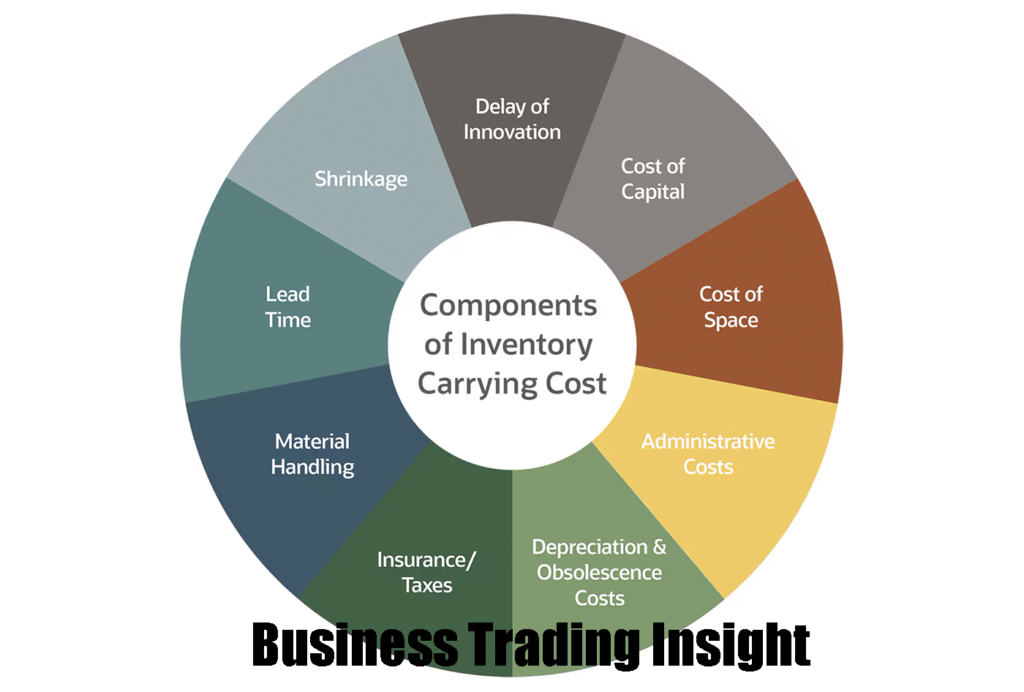

Components of Cost of Carry

The main components of Cost of Carry typically include:

- Financing Costs: These are the interest rates or other borrowing costs incurred to purchase or hold an asset.

- Storage Costs: These are the expenses related to the physical storage of an asset, applicable if the asset is a tangible commodity.

- Insurance Costs: These cover the insurance of the asset against various risks.

- Opportunity Costs: This is the potential income lost from an alternative use of the funds.

Detailed Examination of Cost of Carry

Grasping the nuances of Cost of Carry is essential for making informed financial decisions. Various factors influence the Cost of Carry, and these can differ based on the type of asset, market conditions, and other variables.

Financing Costs

Financing costs are a significant part of the Cost of Carry. They represent the interest or borrowing costs needed to finance the purchase or holding of an asset. For instance, if an investor borrows money to buy stocks or commodities, the interest paid on the borrowed funds constitutes a financing cost.

Storage Costs

Storage costs come into play primarily for physical commodities like oil, gold, or agricultural products. These costs include warehousing fees, security, and maintenance expenses. For financial instruments, storage costs might be negligible or non-existent.

Insurance Costs

Insurance costs are the expenses associated with protecting the asset from risks such as theft, damage, or other unforeseen events. For valuable physical commodities, insurance can be a significant component of the Cost of Carry.

Opportunity Costs

Opportunity costs reflect the income forgone from not using the funds elsewhere. For example, if money is tied up in an asset, it cannot be used to earn interest in a savings account or invest in other opportunities. This potential loss of income must be considered in the total Cost of Carry.

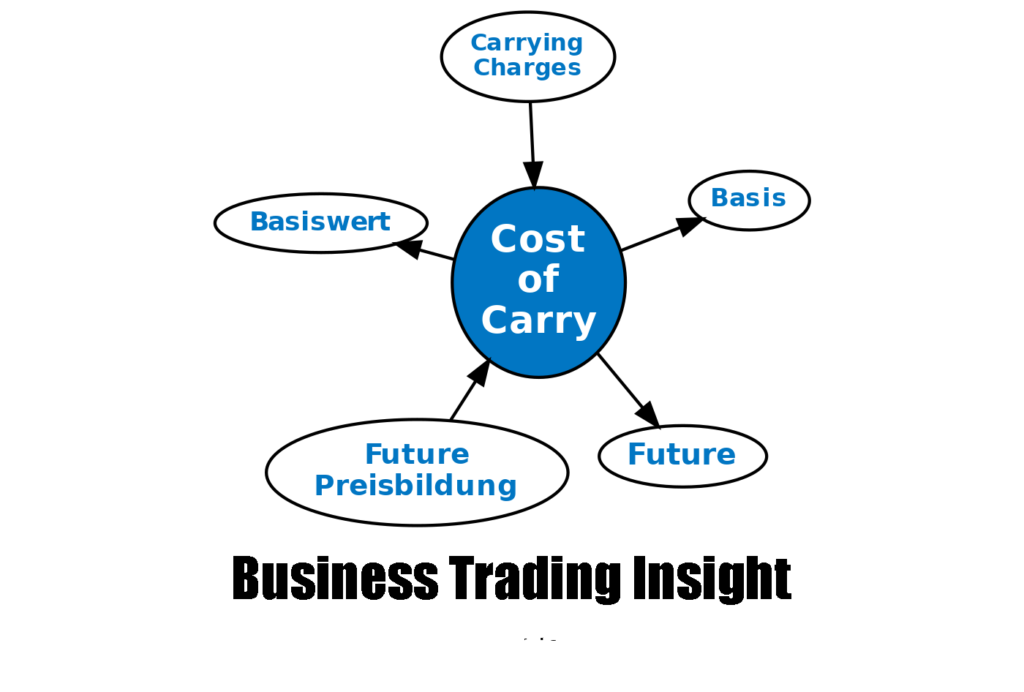

Futures Cost of Carry Model

The Cost of Carry model for futures is used to determine the theoretical price of a futures contract. This model incorporates the current market price of the underlying asset, the Cost of Carry, and any income derived from holding the asset, such as dividends. The formula for calculating the theoretical price of a futures contract can be expressed as follows:

F = S × ( 1 + r × t ) − I

where:

- F is the theoretical futures price,

- S is the current spot price of the underlying asset,

- r is the risk-free interest rate,

- t is the time to maturity of the futures contract,

- I is the income from the underlying asset (e.g., dividends).

Practical Application of the Model

To illustrate, suppose the current price of a stock is $100, the risk-free interest rate is 5%, the futures contract expires in one year, and the expected dividend income is $2. The theoretical price of the futures contract would be calculated as:

F = 100 × ( 1 + 0.05 × 1 ) − 2 = 103

This simplified model helps traders and investors understand the fair value of futures contracts and make more informed trading decisions.

Cost of Carry in Other Derivative Markets

Cost of Carry is not limited to futures markets. It plays a crucial role in the pricing and valuation of various derivative instruments, including options, swaps, and forwards.

Options

In options trading, Cost of Carry can influence the premium paid for the option. The cost of holding the underlying asset, including any financing or storage costs, is factored into the option’s price. For instance, in a call option, the cost of holding the underlying asset until the option’s expiration is considered when determining the premium.

Swaps

Swaps, such as interest rate swaps or commodity swaps, also consider the Cost of Carry. For instance, in a commodity swap, the cost of carrying the underlying commodity is included in the swap’s pricing to reflect the true cost of the agreement.

Forwards

Forwards are similar to futures but are traded over-the-counter (OTC). The Cost of Carry model for forwards is analogous to that of futures, where the costs associated with holding the underlying asset until the contract’s maturity are taken into account.

Net Return Calculations

Calculating net return involves accounting for the Cost of Carry to determine the actual profit or loss from an investment. The formula for calculating net return is as follows:

Net Return = Gross Return − Cost of Carry

where:

- Net Return is the actual profit or loss after accounting for all carrying costs,

- Gross Return is the total return from the asset before expenses,

- Cost of Carry includes all associated costs of holding the asset.

Example of Net Return Calculation

Consider an investor who purchases a stock for $100 and sells it one year later for $120. If the Cost of Carry, including financing and storage costs, is $5, the net return can be calculated as:

Net Return = 120 − 100 − 5 = 15

In this example, the net return is $15, reflecting the true profit after accounting for the carrying costs.

Importance of Cost of Carry in Investment Decisions

Understanding the Cost of Carry is crucial for making informed investment decisions. It helps investors and traders accurately evaluate the profitability of holding an asset and anticipate potential costs. By factoring in these costs, investors can better assess the true value of their investments and develop more effective trading strategies.

Factors Affecting Cost of Carry

Several factors can influence the Cost of Carry, including:

- Interest Rates: Changes in interest rates can affect financing costs.

- Market Conditions: Volatility and market dynamics can impact storage and insurance costs.

- Asset Type: Different assets have varying storage and insurance requirements.

- Economic Factors: Inflation, currency fluctuations, and economic policies can affect overall carrying costs.

Strategies to Mitigate Cost of Carry

Investors can employ various strategies to mitigate the impact of Cost of Carry, such as:

- Hedging: Using derivatives to hedge against potential losses.

- Diversification: Spreading investments across different assets to reduce risk.

- Efficient Use of Leverage: Minimizing borrowing costs by using leverage judiciously.

Benefits of Considering Cost of Carry

Taking into account the Cost of Carry provides several benefits:

- Accurate Pricing: Ensures more precise pricing of derivatives and other financial instruments.

- Improved Risk Management: Helps in better managing the risks associated with holding assets.

- Enhanced Profitability: Assists in identifying the true profitability of investments after accounting for all costs.

The concept of Cost of Carry is a fundamental aspect of financial markets, influencing the pricing and valuation of various assets and derivatives. By comprehensively understanding and accounting for the Cost of Carry, investors and traders can make more informed decisions, accurately assess the profitability of their investments, and develop effective trading strategies. This knowledge is essential for navigating the complexities of modern financial markets and achieving long-term investment success.